Today's Michigan Mortgage Rates

We do Mortgages in Michigan

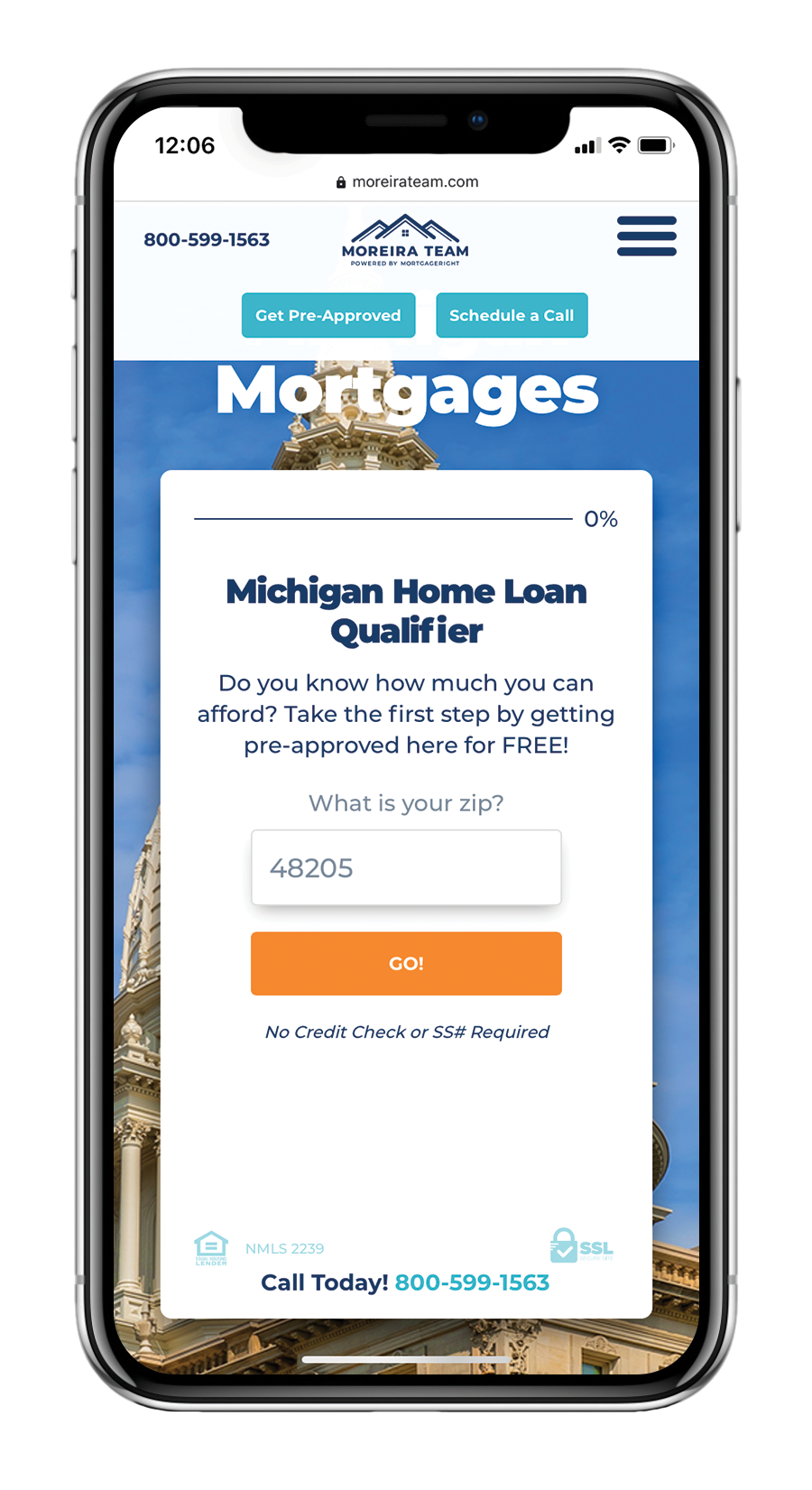

We do Mortgages in Michigan. Call 800-599-1563 or fill out the form on this page for a mortgage quick quote. Its takes less than a minute to find out what you can afford.

Do you ever ask yourself, “How do I get a mortgage in Michigan?” or “Who will give me a home loan in Michigan?” Great News! You've found the answer with Moreira Team! We are mortgage brokers in Michigan.

The mortgage process can be tedious and the time it takes can really drag out. Moreira Team, a wholesale mortgage broker in Michigan, will help you get the mortgage you need at a price you can afford and in a timeline that makes sense. That’s right, we’ll make your Michigan mortgage fast and easy! There’s no need to babysit the process or figure out how everything is going to get done on time, we handle it all from start to finish. Your Michigan mortgage can't get any easier than this.

Let’s face it. The traditional mortgage experience is brutal.

That is why we have made it our purpose, for more than a decade, to provide our clients with the best mortgage experience possible. We have the mortgage know-how and experience to make the home loan process “done-for-you”. Getting a mortgage with us is actually a lot easier than you might think, and we have programs available for every situation. We shop your loan with over 22 different lenders and banks to make sure we deliver on our promise to get you the best deal. That means you save money, get a lower rate, and spend less money out of pocket. Our guarantee is to provide you with a transparent and easy home buying experience, and our promise is to find you the best deal.

Are you looking to buy a home?

Enter a location above to start searching for homes in your area.

Be sure to enter your email address and click "Go" to recieve your custom buyer digest for your area.

Here's a few easy steps to get started on your mortgage:

-

Step 1

Analyze Your Goals

Having a solid idea of your wants and needs is a great place to start. What are your home needs? What area do you want to live in? What is your current financial situation? What monthly payment are you conformable paying each month? -

Step 2

Have a Conversation

Call 800-599-1563 to talk to a licensed mortgage advisor to get a custom strategy on how to make your home purchase a reality. A mortgage advisor will be able to tell you exactly how much home you can afford given your unique circumstances. -

Step 3

Get Approved Fast

To get the mortgage process rolling you will want to get pre-approved. You can do this yourself by clicking below or a mortgage advisor can help you step-by-step right over the phone. It takes very little time and lets you know right away how much you are approved for. Get Pre-Approved

Find Out How Much You Can Afford (and Save!) with Our Mortgage Calculators

A mortgage calculator can help you see how much mortgage you can afford on your home. It can also help you figure out how much you can save by exploring different down payment and term options. Below we have a mortgage calculator and an affordability calculator. Feel free to play around with some numbers. And if you have any questions or want to talk more about your options give us a call or schedule a time to talk with a licensed mortgage advisor.

We do mortgages in these Michigan areas:

Cities in Wayne County where we do Mortgages:

- Detroit

- Wayne

- Westland

- Dearborn

- Canton

- Livonia

- Taylor

- Inkster

- Romulus

- Plymouth

- Redford Charter Township

- Belleville

- Hamtramck

- Lincoln Park

- Allen Park

- Grosse Pointe

- Dearborn Heights

- Southgate

- Wyandotte

- Garden City

- Van Buren Charter Township

- Highland Park

- Grosse Ile Township

- Harper Woods

- Flat Rock

- Grosse Pointe Farms

- Ecorse

- Grosse Pointe Woods

- Brownstown Charter Township

- Grosse Pointe Park

- Melvindale

- River Rouge

- Woodhaven

- Riverview

- Trenton

- Plymouth Charter Township

- Township of Northville

- Huron Charter Township

- Township of Sumpter

- Gibraltar

- Rockwood

Cities in Oakland County where we do Mortgages:

- Pontiac

- Waterford Township

- Troy

- Oakland charter Township

- Clarkston

- Rochester Hills

- Royal Oak

- Rochester

- Southfield

- Novi

- Orion charter Township

- Auburn Hills

- West Bloomfield Township

- Farmington Hills

- Lake Orion

- White Lake charter Township

- Bloomfield Hills

- Madison Heights

- Birmingham

- Ferndale

- Commerce Charter Township

- Oak Park

- Bloomfield Township

- Holly

- South Lyon

- Walled Lake

- Wixom

- Highland Charter Township

- Clawson

- Berkley

- Milford Charter Township

- Farmington

- Independence charter Township

- Huntington Woods

- Hazel Park

- Lyon Charter Township

- Beverly Hills

- Orchard Lake Village

- Keego Harbor

- Pleasant Ridge

- Sylvan Lake

- Lathrup Village

- Lake Angelus

- Brandon Township

- Bingham Farms

- Franklin

- Royal Oak Charter Township

- Leonard

Cities in Macomb County where we do Mortgages:

- Clinton Township

- Warren

- Sterling Heights

- Shelby Charter Township

- Mount Clemens

- Roseville

- St. Clair Shores

- Eastpointe

- Harrison charter Township

- Utica

- New Baltimore

- Fraser

- Romeo

- Armada

- New Haven

- Center Line

Cities in Kent County where we do Mortgages:

- Grand Rapids

- Rockford

- Wyoming

- Kentwood

- Caledonia

- Grandville

- Cedar Springs

- Kent City

- Lowell

- Byron Center

- Walker

- Sparta

- Comstock Park

- Plainfield charter Township

- Cascade

- East Grand Rapids

- Grand Rapids charter Township

- Sand Lake

- Lowell charter Township

- Forest Hills

- Cutlerville

Cities in Genesee County where we do Mortgages:

- Flint

- Grand Blanc

- Davison

- Burton

- Clio

- Flushing

- Swartz Creek

- Mount Morris

- Flint Township

- Linden

- Grand Blanc Township

- Fenton Township

- Montrose

- Goodrich

- Mount Morris Township

- Otisville

- Vienna Township

- Clayton Township

- Argentine Township

- Montrose Township

- Gaines

- Beecher

- Flushing Township

Cities in Washtenaw County where we do Mortgages:

- Ann Arbor

- Ypsilanti

- Saline

- Chelsea

- Dexter

- Ypsilanti Charter Township

- Pittsfield Charter Township

- Superior Charter Township

- Manchester

- Ann Arbor Charter Township

- York charter Township

Cities in Ingham County where we do Mortgages:

- Mason

- Meridian charter Township

- Williamston

- Delhi charter Township

- Dansville

- Stockbridge

- Webberville

- Leslie

- Edgemont Park

Cities in Ottawa County where we do Mortgages:

- Grand Haven

- Hudsonville

- Zeeland

- Spring Lake

- Allendale Charter Township

- Coopersville

- Georgetown Township

- Ferrysburg

- Jamestown

- Zeeland charter Township

- Polkton Charter Township

- Beechwood

Cities in Kalamazoo County where we do Mortgages:

- Kalamazoo

- Portage

- Kalamazoo Township

- Vicksburg

- Galesburg

- Comstock Township

- Richland

- Schoolcraft

- Texas charter Township

- Parchment

- Augusta

- Cooper Township

- Climax

- Comstock Northwest

- South Gull Lake

- Greater Galesburg

Cities in Livingston County where we do Mortgages:

- Howell

- Brighton

- Fowlerville

- Pinckney

- Township of Hamburg

Cities in Saginaw County where we do Mortgages:

- Saginaw

- Frankenmuth

- Freeland

- Birch Run

- Saint Charles

- Chesaning

- Bridgeport charter Township

- Carrollton Township

- Thomas Township

- Buena Vista charter Township

- Hemlock

- Zilwaukee

- Tittabawassee Township

- Merrill

- Burt

- Oakley

Cities in Muskegon County where we do Mortgages:

- Muskegon

- Norton Shores

- Whitehall

- Muskegon Heights

- North Muskegon

- Fruitport Charter Township

- Montague

- Twin Lake

- Roosevelt Park

- Ravenna

- Muskegon charter Township

- Lakewood Club

Cities in St. Clair County where we do Mortgages:

- Saint Clair

- Port Huron

- Marine City

- Algonac

- Marysville

- Township of Cottrellville

- Fort Gratiot Township

- Yale

- Clay Township

- China Township

- Capac

- East China

- Port Huron charter Township

- Casco Township

- Emmett

Cities in Jackson County where we do Mortgages:

- Jackson

- Brooklyn

- Grass Lake Charter Township

- Spring Arbor

- Michigan Center

- Parma

- Blackman

- Summit Township

- Concord

- Springport

- Napoleon

- Hanover

Cities in Berrien County where we do Mortgages:

- Berrien Springs

- St. Joseph

- Benton Harbor

- New Buffalo

- Stevensville

- Buchanan

- Coloma

- Bridgman

- Three Oaks

- Watervliet

- Baroda

- Eau Claire

- Galien

- Lake Charter Township

- Sodus Township

- Michiana

- Coloma charter Township

- Shoreham

- Grand Beach

- Lake Michigan Beach

- New Troy

- Fair Plain

- Benton Heights

Cities in Monroe County where we do Mortgages:

- Monroe

- Dundee

- Temperance

- Carleton

- Erie

- Petersburg

- Lambertville

- Monroe Charter Township

- Luna Pier

- Maybee

- La Salle

- Charter Township of Berlin

Cities in Calhoun County where we do Mortgages:

- Battle Creek

- Marshall

- Albion

- Emmett Charter Township

- Springfield

- Pennfield Charter Township

- Homer

- Tekonsha

- Bedford Charter Township

- Athens

- Burlington

- Brownlee Park

Cities in Allegan County where we do Mortgages:

- Allegan

- Plainwell

- Saugatuck

- Otsego

- Fennville

- Wayland

- Douglas

- Martin

- Hopkins

- Ganges Township

Cities in Eaton County where we do Mortgages:

- Charlotte

- Eaton Rapids

- Delta Charter Township

- Potterville

- Olivet

- Vermontville

- Bellevue

- Oneida Charter Township

- Sunfield

- Mulliken

- Windsor Charter Township

Cities in Bay County where we do Mortgages:

- Bay City

- Essexville

- Pinconning

- Auburn

- Bangor Charter Township

- Hampton Township

- Williams Charter Township

- Portsmouth Charter Township

Cities in Lenawee County where we do Mortgages:

- Adrian

- Tecumseh

- Hudson

- Blissfield

- Onsted

- Morenci

- Clinton

- Madison Charter Township

- Addison

- Manitou Beach-Devils Lake

- Britton

- Deerfield

- Clayton

- Jasper

Cities in Grand Traverse County where we do Mortgages:

- Kingsley

- Interlochen

- Garfield Township

- Grawn

- Fife Lake

- Grant Township

Cities in Lapeer County where we do Mortgages:

- Lapeer

- Imlay City

- Metamora

- North Branch

- Almont

- Columbiaville

- Dryden

- Dryden Township

- Deerfield Township

- Clifford

Cities in Midland County where we do Mortgages:

- Sanford

- Larkin Charter Township

- Midland charter Township

- Coleman

Cities in Clinton County where we do Mortgages:

- Saint Johns

- DeWitt

- Ovid

- Bath Township

- Watertown Township

- Elsie

- Fowler

- Westphalia

- Maple Rapids

- Eagle

- Lake Victoria

Cities in Van Buren County where we do Mortgages:

- Paw Paw

- Hartford

- Bangor

- Decatur

- Gobles

- Lawrence

- Bloomingdale

- Mattawan

- Lawton

- Breedsville

- South Haven Charter Township

Cities in Isabella County where we do Mortgages:

- Mount Pleasant

- Weidman

- Lake Isabella

- Shepherd

- Rosebush

- Union charter Township

- Nottawa

- Loomis

Cities in Shiawassee County where we do Mortgages:

- Owosso

- Corunna

- Durand

- Laingsburg

- Perry

- Morrice

- Bancroft

- Owosso Charter Township

- Vernon

- New Lothrop

- Byron

- Caledonia Township

- Henderson

Cities in Marquette County where we do Mortgages:

- Marquette

- Ishpeming

- Negaunee

- Gwinn

- Harvey

- Michigamme Township

- Ishpeming Township

- Powell

- West Ishpeming

- Richmond Township

Cities in Ionia County where we do Mortgages:

- Ionia

- Portland

- Belding

- Saranac

- Lake Odessa

- Pewamo

- Muir

- Lyons

- Clarksville

Cities in Montcalm County where we do Mortgages:

- Greenville

- Stanton

- Carson City

- Howard City

- Edmore

- Lakeview

- Sheridan

- Pierson

- McBride

- Belvidere Township

Cities in Barry County where we do Mortgages:

- Hastings

- Delton

- Middleville

- Nashville

- Hastings Charter Township

- Freeport

- Rutland Charter Township

- Woodland

- Dowling

- Hickory Corners

Cities in St. Joseph County where we do Mortgages:

- Centreville

- Sturgis

- Three Rivers

- White Pigeon

- Mendon

- Constantine

- Colon

- Burr Oak

Cities in Tuscola County where we do Mortgages:

- Caro

- Vassar

- Cass City

- Mayville

- Millington

- Unionville

- Fairgrove

- Reese

- Gagetown

- Kingston

- Akron

- Fostoria

Cities in Cass County where we do Mortgages:

- Cassopolis

- Dowagiac

- Edwardsburg

- Vandalia

- Marcellus

Cities in Newaygo County where we do Mortgages:

- Newaygo

- Fremont

- White Cloud

- Grant

- Croton Township

- Sheridan Charter Township

Cities in Hillsdale County where we do Mortgages:

- Hillsdale

- Jonesville

- Reading

- Litchfield

- Osseo

- Camden

- North Adams

- Allen

- Waldron

- Montgomery

Cities in Branch County where we do Mortgages:

- Coldwater

- Quincy

- Bronson

- Sherwood

Cities in Mecosta County where we do Mortgages:

- Mecosta

- Big Rapids

- Stanwood

- Barryton

- Morley

- Canadian Lakes

- Green Charter Township

- Big Rapids Township

Cities in Sanilac County where we do Mortgages:

- Sandusky

- Port Sanilac

- Lexington

- Croswell

- Marlette

- Carsonville

- Deckerville

- Peck

- Forestville

- Snover

- Minden City

- Applegate

- Melvin

Cities in Gratiot County where we do Mortgages:

- Ithaca

- Alma

- St. Louis

- Breckenridge

- Perrinton

- Ashley

Cities in Chippewa County where we do Mortgages:

- Sault Ste. Marie

- Kinross Charter Township

- Drummond

- Bay Mills

- De Tour Village

- Bay Mills Township

Cities in Delta County where we do Mortgages:

- Escanaba

- Gladstone

- Garden

Cities in Houghton County where we do Mortgages:

- Houghton

- Hancock

- Lake Linden

- Calumet Township

- Dollar Bay

- South Range

- Portage charter Township

- Torch Lake Township

- Hubbell

Cities in Wexford County where we do Mortgages:

- Cadillac

- Manton

- Mesick

- Harrietta

- Buckley

- Boon

- Haring charter Township

- Caberfae

- Wedgewood

Cities in Emmet County where we do Mortgages:

- Petoskey

- Harbor Springs

- Alanson

- Pellston

- Levering

- Carp Lake

- Cross Village

- Brutus

- Oden

- Conway

- Ponshewaing

Cities in Huron County where we do Mortgages:

- Bad Axe

- Caseville

- Port Austin

- Harbor Beach

- Ubly

- Sebewaing

- Elkton

- Kinde

- Port Hope

- Pigeon

- Owendale

- Bay Port

- Pointe aux Barques

Cities in Clare County where we do Mortgages:

- Harrison

- Farwell

- Garfield Township

Cities in Mason County where we do Mortgages:

- Scottville

- Ludington

- Free Soil

- Custer

- Fountain

- Pere Marquette Charter Township

Cities in Alpena County where we do Mortgages:

- Alpena

- Herron

- Hubbard Lake

- Lachine

- Ossineke

Cities in Oceana County where we do Mortgages:

- Hart

- Pentwater

- Shelby

- New Era

- Walkerville

- Rothbury

Cities in Charlevoix County where we do Mortgages:

- Charlevoix

- Boyne City

- East Jordan

- Boyne Falls

- Walloon Lake

- Horton Bay

- Bay Shore

- Ironton

- St. James

- Advance

- Norwood

Cities in Gladwin County where we do Mortgages:

- Gladwin

- Beaverton

Cities in Cheboygan County where we do Mortgages:

- Cheboygan

- Indian River

- Wolverine

Cities in Dickinson County where we do Mortgages:

- Iron Mountain

- Kingsford

- Norway

- Quinnesec

- Foster City

Cities in Iosco County where we do Mortgages:

- Oscoda

- Tawas City

- East Tawas

- Au Sable Charter Township

- Whittemore

- Sand Lake

Cities in Otsego County where we do Mortgages:

- Gaylord

- Vanderbilt

Cities in Manistee County where we do Mortgages:

- Manistee

- Onekama

- Bear Lake

- Wellston

- Kaleva

- Arcadia

- Brethren

- Copemish

- Eastlake

- Filer Charter Township

- Stronach

- Oak Hill

Cities in Roscommon County where we do Mortgages:

- Roscommon

- Houghton Lake

- Prudenville

- Roscommon Township

- Richfield Township

Cities in Osceola County where we do Mortgages:

- Reed City

- Evart

- Marion

- Le Roy

- Hersey

- Tustin

Cities in Antrim County where we do Mortgages:

- Bellaire

- Elk Rapids

- Mancelona

- Central Lake

- Torch Lake Township

- Alden

- Eastport

- Ellsworth

- Milton Township

- Alba

Cities in Menominee County where we do Mortgages:

- Menominee

- Stephenson

- Daggett

- Powers

- Carney

Cities in Leelanau County where we do Mortgages:

- Lake Leelanau

- Leland

- Suttons Bay

- Glen Arbor

- Northport

- Empire

- Omena

- Elmwood Charter Township

- Maple City

Cities in Ogemaw County where we do Mortgages:

- West Branch

- Rose City

- Prescott

- Lupton

- Mills Township

- Churchill Township

Cities in Kalkaska County where we do Mortgages:

- Kalkaska

- South Boardman

- Rapid City

Cities in Benzie County where we do Mortgages:

- Frankfort

- Beulah

- Benzonia

- Honor

- Thompsonville

- Elberta

- Lake Ann

Cities in Missaukee County where we do Mortgages:

- Lake City

- McBain

Cities in Arenac County where we do Mortgages:

- Standish

- Au Gres

- Omer

- Twining

- Sterling

- Turner

Cities in Crawford County where we do Mortgages:

- Grayling

- Grayling Charter Township

- Beaver Creek Township

- Frederic Township

- Grayling Township

- Lovells Township

- Maple Forest Township

- South Branch Township

Cities in Gogebic County where we do Mortgages:

- Ironwood

- Bessemer

- Wakefield

- Watersmeet

- Marenisco

Cities in Presque Isle County where we do Mortgages:

- Rogers City

- Onaway

- Posen

- Millersburg

- Presque Isle Harbor

- Bismarck Township

Cities in Lake County where we do Mortgages:

- Baldwin

- Luther

Cities in Iron County where we do Mortgages:

- Iron River

- Crystal Falls

- Caspian

- Gaastra

- Amasa

- Alpha

Cities in Mackinac County where we do Mortgages:

- Mackinac Island

- St. Ignace

- Gould City

Cities in Alcona County where we do Mortgages:

- Harrisville

- Lincoln

- Hubbard Lake

Your Michigan 5 Star Mortgage Broker

Your Michigan Home Loan Comparison Tool

Purchase Price

Down Payment

Down Payment Amount: $36,000

For 20% down payment, you may qualify for the following mortgage loans:

USDA Mortgage

The USDA loan is one of the best zero down payment loans still available today. Its location based meaning it has to be in a USDA approved area and eligibility is determined by household income. Many rural and suburban neighborhoods across American are eligible so it’s a perfect fit for first time and repeat home buyers that want to live in a more rural setting outside city limits.

VA Home Loan

The VA home loan is available to veterans, active military personal, and eligible spouses who have VA entitlement. It required a zero-down payment, requires no mortgage insurance, and offers flexible underwriting guidelines. It’s one of the best programs available today from an affordability standpoint and offers below market rates.

HomeReady / HomePossible

This conventional loan program assists low- to moderate-income borrowers with loans made for certain low-income areas along with more developed areas-based income eligibility. Must be a first-time homebuyer. The programs offers very flexible guidelines with a low 3% down payment and reduced mortgage insurance amounts for approved borrowers.

Conventional 97

The Conventional 97 program is a type of low-down payment mortgage for first time home buyers. There are no income limit restrictions. Borrowers only need to come up with a 3% down payment which makes it a 97% Loan to Value loan. That’s where the program gets its name. It allows for a gift for the down payment and offers common sense underwriting guidelines.

FHA Home Loan

An FHA mortgage is one of the most popular home purchase programs available today, not only for first time home buyers but repeat buyers as well. It requires a small 3.5% down payment and is perfect for borrowers with less than excellent credit, lower income, or past credit events like: foreclosure, bankruptcy, or short sale. This is a government-sponsored program designed to help more people become homeowners. That why the payments are affordable, guidelines are flexible and it offers common sense underwriting.

Conventional 95

The Standard conventional loan offers a low-down payment of 5% and offers loans up to the conventional loan limit currently $510,400. It is designed for borrowers with good to excellent credit (700 or higher) and offers attractive rates and reduced mortgage insurance. The guidelines are less restrictive for borrowers that are considered risk due to a high credit score, solid work history and a low debt to income ratio.

80-10-10

An 80-10-10 loan also known as a “piggyback loan” lets you buy a home with two mortgages that total 90% of the purchase price with only a 10% down payment. Borrowers get a first and second mortgage simultaneously: one for 80% of the purchase price, and one for 10%. One loan “piggybacks” on top of the other. This strategy avoids borrowers paying private mortgage insurance and sidesteps the strict lending requirements of jumbo loans. By taking advantage of this program the overall payment is often less than doing a traditional jumbo mortgage with offers higher interest rates and more restrictive underwriting.

Conventional Home Loan

Unlike the popular belief that 20% is required for this program you can qualify for a conventional home loan with as little as 10% down. Although mortgage insurance is required many home buyers are surprised to learn how affordable it really is with solid credit. This strategy makes sense versus coming up with a large 20% down payment to avoid mortgage insurance entirely.

Traditional Conventional Mortgage

The Traditional Conventional Mortgage option requires no private mortgage insurance (PMI) with 20% down and offers the most favorable terms including the most attractive rates. For borrowers who have a large down payment and great credit it’s the best option when purchasing your home or condo.

Multi-Unit & Investments

You can buy a duplex, triplex, or four-plex by making a down payment of 25% or more. Purchasing a multi-unit home is a great way to get your rental portfolio jump started as a landlord or as a primary residence if plan to move into one of the units and rent out the rest of the units. Whether you plan to live in one of the units or rent out the entire building this program is excellent to secure an income producing property. Homes with up to four units are eligible for the conventional mortgage program.

Find Out How Much Your Michigan Home is Worth!

Enter your address above and and check the esimated value of your home.

Be sure to enter your email address and click "Go" to recieve your custom monthly digest.

Mortgages Explained Michigan: Different Programs

So, you’re ready for a mortgage? Are you a first-time homebuyer or a seasoned investor? Maybe you’re ready to refinance for better rates or get cash out to update your home. No matter what your home loan needs are, you’re in good hands. We have mortgage programs for every situation.

First Time Home Buyer Mortgage

Buying a home for the first time can be a stressful and confusing situation. Where do you start? Can you afford it? The good news is we have a comprehensive list of the best loan programs that you, as a first time home buyer, can take advantage of. These programs offer different benefits depending on your unique situation and are designed to help you reach your goal of homeownership. All with less money out of your own pocket.

- Down payment as low as 3%

- Numerous programs available

- 640 credit score required

Conventional Mortgage

Conventional mortgage loans offer a unique opportunity for borrowers to become homeowners or refinance with more favorable terms. The program has stricter guidelines compared to other loan programs but can be more affordable depending on your financial situation (income, credit score, debts). You will often see down payment requirements as low as 3% – 5% in most cases. One thing you need to know about a conventional home loan is that it is not guaranteed by Uncle Sam. These loans may be a bit tougher to get and can have more stringent qualifications, but the benefit may be worth it.

- 3%-5% down payment

- Above average credit

- Low fixed payment

FHA Mortgage

The FHA loan program has been more popular than ever the last few years as credit has become harder to get. Getting an FHA loan is popular for new first-time home buyers as well as those who have been through a financial credit event like a short sale, foreclosure or other financial hardship in the past and are looking to get a mortgage to get back on track. It was created to help more borrowers realize the dream of homeownership due to its lenient underwriting guidelines and low-down payment options. Due to this, it’s considered the most flexible home loan program available today.

- 3.5% down payment

- Past credit event OK

- Low credit OK

VA Mortgage

The three core advantages of a VA Loan are that it’s specifically tailored to meet the home buying needs of veterans, current service members and military families with flexible terms. These Government backed loans make it possible for veterans to get some of the best financing available for purchasing a new home. The three main areas that benefit Veterans the most are:

- 100% financing

- Below market rates

- No mortgage insurance

Jumbo Mortgage

Jumbo Mortgages offer a unique opportunity for borrowers to buy luxury homes that exceed the conforming loan limit of $806,500. Jumbo mortgage loans have a little stricter lending requirement than other programs but still packs a punch when it comes to upping your buying power. A common misconception about jumbo loans is that you need a 20% down payment in order to qualify. The reality is jumbo financing allows you to purchase with as little as 5% to 10% down with a little creative financing. Yes, that’s right! 5% to 10% down, not the traditional 20%. This is accomplished by establishing a 1st mortgage at the conventional loan limit of $806,500 and 2nd mortgage for the rest of the balance. This “combo loan” avoids mortgage insurance and usually offers the lowest fixed payment.

- 5%-10% down payment

- 660 credit score required

- No mortgage insurance

Bank Statement Only

The program helps self-employed borrowers with write offs qualify for a home loan. Borrowers who claim their expenses for their business and reduce their adjusted gross income (AGI). It was designed to help responsible self-employed borrowers purchase a home using only bank statements instead of the traditional personal and business tax returns along with other extensive paperwork.

- 10% down payment

- Bank statement only

- No tax returns required

USDA Mortgage

The USDA Rural Development’s Single-Family Housing Guaranteed Loan Program is designed to help borrowers, low to moderate income earners purchase homes in rural areas. USDA home purchase loans are an excellent benefit for first time home buyers as well as growing families looking to upgrade their living situation. USDA loans are a very attractive 100% financing option for borrowers looking for an affordable home loan option.

- 100% financing

- Rural properties only

- 620 credit score required