Today's Louisiana Mortgage Rates

We do Mortgages in Louisiana

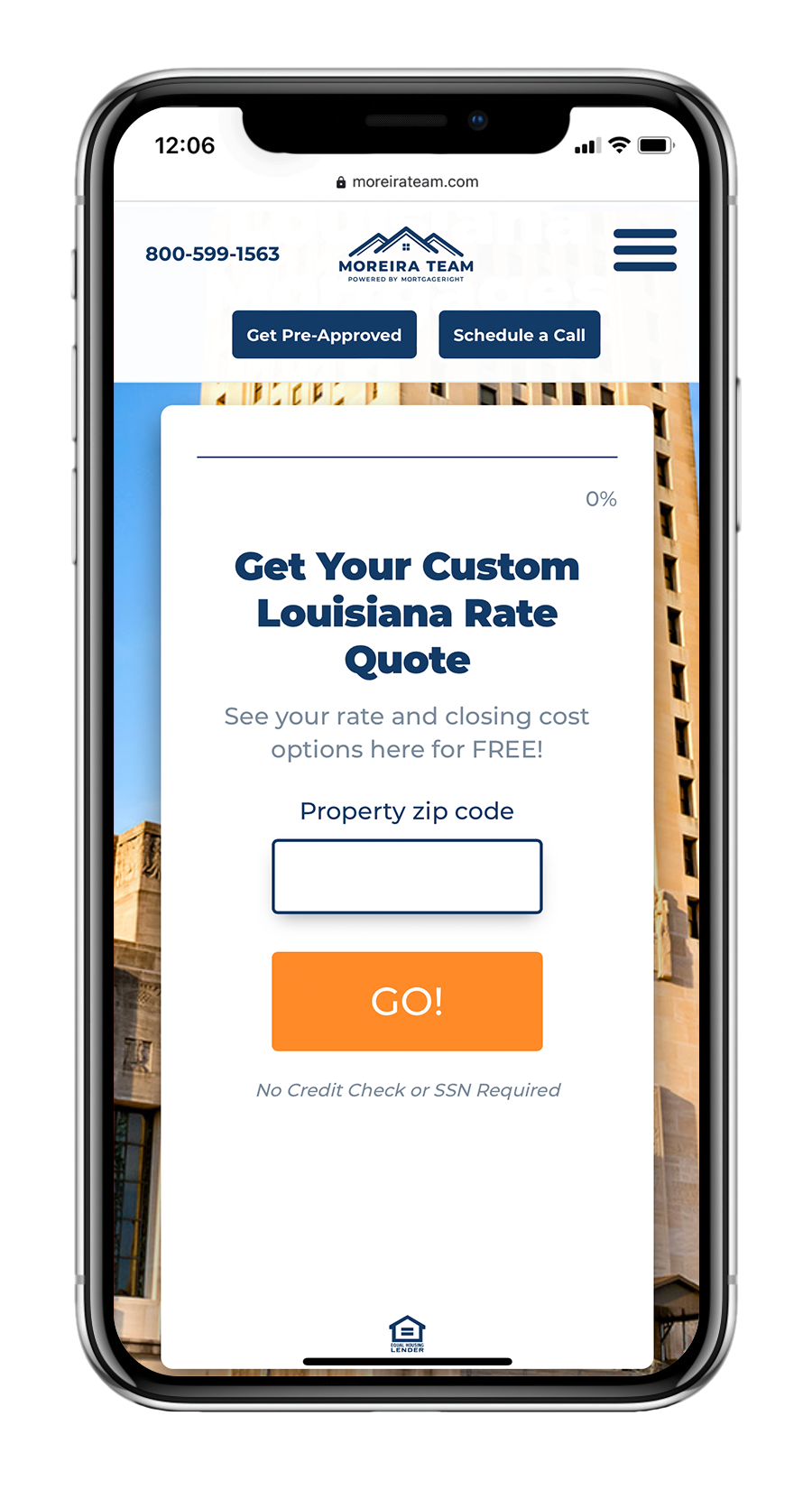

We do Mortgages in Louisiana. Call 404-238-7888 or fill out the form on this page for a mortgage quick quote. Its takes less than a minute to find out what you can afford.

Do you ever ask yourself, “How do I get a mortgage in Louisiana?” or “Who will give me a home loan in Louisiana?” Great News! You've found the answer with Moreira Team! We are mortgage brokers in Louisiana.

The mortgage process can be tedious and the time it takes can really drag out. Moreira Team, a wholesale mortgage broker in Louisiana, will help you get the mortgage you need at a price you can afford and in a timeline that makes sense. That’s right, we’ll make your Louisiana mortgage fast and easy! There’s no need to babysit the process or figure out how everything is going to get done on time, we handle it all from start to finish. Your Louisiana mortgage can't get any easier than this.

Let’s face it. The traditional mortgage experience is brutal.

That is why we have made it our purpose, for more than a decade, to provide our clients with the best mortgage experience possible. We have the mortgage know-how and experience to make the home loan process “done-for-you”. Getting a mortgage with us is actually a lot easier than you might think, and we have programs available for every situation. We shop your loan with over 22 different lenders and banks to make sure we deliver on our promise to get you the best deal. That means you save money, get a lower rate, and spend less money out of pocket. Our guarantee is to provide you with a transparent and easy home buying experience, and our promise is to find you the best deal.

Are you looking to buy a home?

Enter a location above to start searching for homes in your area.

Be sure to enter your email address and click "Go" to recieve your custom buyer digest for your area.

Here's a few easy steps to get started on your mortgage:

-

Step 1

Analyze Your Goals

Having a solid idea of your wants and needs is a great place to start. What are your home needs? What area do you want to live in? What is your current financial situation? What monthly payment are you conformable paying each month? -

Step 2

Have a Conversation

Call 404-238-7888 to talk to a licensed mortgage advisor to get a custom strategy on how to make your home purchase a reality. A mortgage advisor will be able to tell you exactly how much home you can afford given your unique circumstances. -

Step 3

Get Approved Fast

To get the mortgage process rolling you will want to get pre-approved. You can do this yourself by clicking below or a mortgage advisor can help you step-by-step right over the phone. It takes very little time and lets you know right away how much you are approved for. Get Pre-Approved

Find Out How Much You Can Afford (and Save!) with Our Mortgage Calculators

A mortgage calculator can help you see how much mortgage you can afford on your home. It can also help you figure out how much you can save by exploring different down payment and term options. Below we have a mortgage calculator and an affordability calculator. Feel free to play around with some numbers. And if you have any questions or want to talk more about your options give us a call or schedule a time to talk with a licensed mortgage advisor.

We do mortgages in these Louisiana areas:

Cities in East Baton Rouge Parish where we do Mortgages:

- Baton Rouge

- Zachary

- Baker

- Central

- Merrydale

- Shenandoah

- Inniswold

- Old Jefferson

- Monticello

- Brownfields

- Westminster

Cities in Orleans Parish where we do Mortgages:

- New Orleans

- Garden District

- Greens Ditch

- Barrington Park

- Pike Fort

- South Point

- Lakeshore West

- Gretna

- Westwego

- Harahan

- Kenner

- Convent

Cities in Caddo Parish where we do Mortgages:

- Shreveport

- Vivian

- Blanchard

- Mooringsport

- Greenwood

- Oil City

- Rodessa

- Belcher

- Hosston

- Ida

- Gilliam

Cities in Jefferson Parish where we do Mortgages:

- Metairie

- Jefferson

- Kenner

- Gretna

- Marrero

- Harvey

- Harahan

- Westwego

- River Ridge

- Elmwood

- Terrytown

- Grand Isle

- Avondale

- Lafitte

- Bridge City

- Jean Lafitte

- Waggaman

- Barataria

- Woodmere

- Timberlane

- Estelle

Cities in St. Tammany Parish where we do Mortgages:

- Covington

- Slidell

- Mandeville

- Folsom

- Lacombe

- Madisonville

- Pearl River

- Abita Springs

- Eden Isle

- Sun

Cities in Lafayette Parish where we do Mortgages:

- Lafayette

- Carencro

- Youngsville

- Scott

- Milton

Cities in Calcasieu Parish where we do Mortgages:

- Lake Charles

- Sulphur

- Westlake

- DeQuincy

- Moss Bluff

- Vinton

- Iowa

- Starks

- Carlyss

- Prien

- Hayes

- Gillis

Cities in Ouachita Parish where we do Mortgages:

- Monroe

- West Monroe

- Sterlington

- Calhoun

- Richwood

- Swartz

- Brownsville-Bawcomville

- Claiborne

- Lakeshore

Cities in Livingston Parish where we do Mortgages:

- Livingston

- Denham Springs

- Walker

- Albany

- Springfield

- French Settlement

- Watson

- Port Vincent

- Killian

Cities in Tangipahoa Parish where we do Mortgages:

- Tangipahoa

- Ponchatoula

- Amite City

- Hammond

- Kentwood

- Independence

- Tickfaw

- Roseland

- Loranger

- Natalbany

Cities in Bossier Parish where we do Mortgages:

- Bossier City

- Haughton

- Benton

- Plain Dealing

- Red Chute

- Eastwood

Cities in Rapides Parish where we do Mortgages:

- Alexandria

- Pineville

- Boyce

- Glenmora

- Lecompte

- Cheneyville

- Deville

- Ball

- Woodworth

- Forest Hill

- Tioga

- McNary

- Echo

Cities in Ascension Parish where we do Mortgages:

- Donaldsonville

- Gonzales

- Prairieville

- Sorrento

- Darrow

Cities in Terrebonne Parish where we do Mortgages:

- Houma

- Bourg

- Chauvin

- Montegut

- Gray

- Dulac

- Schriever

- Bayou Cane

Cities in Lafourche Parish where we do Mortgages:

- Thibodaux

- Raceland

- Lockport

- Golden Meadow

- Cut Off

- Galliano

- Larose

- Mathews

- Choctaw

- Bayou Country Club

Cities in St. Landry Parish where we do Mortgages:

- Opelousas

- Grand Coteau

- Port Barre

- Sunset

- Krotz Springs

- Washington

- Leonville

- Melville

- Cankton

- Lawtell

- Palmetto

- Morrow

Cities in Iberia Parish where we do Mortgages:

- New Iberia

- Jeanerette

- Loreauville

- Lydia

Cities in Acadia Parish where we do Mortgages:

- Church Point

- Crowley

- Rayne

- Iota

- Estherwood

- Mermentau

- Morse

- Egan

- Branch

- Midland

Cities in Vermilion Parish where we do Mortgages:

- Abbeville

- Gueydan

- Kaplan

- Erath

- Maurice

- Perry

Cities in St. Charles Parish where we do Mortgages:

- Luling

- Destrehan

- Hahnville

- Norco

- Boutte

- Saint Rose

- Killona

- New Sarpy

- Bayou Gauche

- Paradis

- Montz

- Ama

- Taft

Cities in St. Martin Parish where we do Mortgages:

- Saint Martinville

- Breaux Bridge

- Cecilia

- Henderson

- Catahoula

- Parks

- Cade

Cities in St. Mary Parish where we do Mortgages:

- Franklin

- Berwick

- Patterson

- Centerville

- Baldwin

- Bayou Vista

- Charenton

- Amelia

- Glencoe

Cities in Lincoln Parish where we do Mortgages:

- Ruston

- Grambling

- Dubach

- Choudrant

- Simsboro

- Vienna

Cities in Vernon Parish where we do Mortgages:

- Leesville

- Fort Polk South

- Anacoco

- New Llano

- Rosepine

- Pitkin

- Hornbeck

- Simpson

- Fort Polk North

Cities in Washington Parish where we do Mortgages:

- Franklinton

- Bogalusa

- Angie

- Varnado

- Rio

Cities in St. Bernard Parish where we do Mortgages:

- Chalmette

- Arabi

- Violet

- Meraux

- Delacroix

- Poydras

Cities in St. John the Baptist Parish where we do Mortgages:

- Reserve

- Garyville

- Wallace

- Pleasure Bend

Cities in Avoyelles Parish where we do Mortgages:

- Marksville

- Bunkie

- Mansura

- Cottonport

- Moreauville

- Hessmer

- Plaucheville

- Simmesport

- Evergreen

- Bordelonville

- Fifth Ward

- Center Point

- Moncla

Cities in Natchitoches Parish where we do Mortgages:

- Natchitoches

- Natchez

- Campti

- Robeline

- Marthaville

- Provencal

- Goldonna

- Clarence

- Ashland

- Powhatan

Cities in Beauregard Parish where we do Mortgages:

- Merryville

- Singer

- Sugartown

- Oretta

Cities in Webster Parish where we do Mortgages:

- Minden

- Springhill

- Cotton Valley

- Doyline

- Sarepta

- Shongaloo

- Dubberly

- Dixie Inn

- Sibley

- Heflin

- Cullen

Cities in Jefferson Davis Parish where we do Mortgages:

- Jennings

- Lake Arthur

- Welsh

- Elton

- Lacassine

- Fenton

- Roanoke

Cities in Evangeline Parish where we do Mortgages:

- Ville Platte

- Mamou

- Pine Prairie

- Turkey Creek

- Chataignier

- Basile

- Reddell

Cities in Iberville Parish where we do Mortgages:

- Plaquemine

- Saint Gabriel

- White Castle

- Maringouin

- Rosedale

- Grosse Tete

- Bayou Goula

- Crescent

Cities in West Baton Rouge Parish where we do Mortgages:

- Port Allen

- Brusly

- Addis

- Erwinville

Cities in De Soto Parish where we do Mortgages:

- Mansfield

- Stonewall

- Logansport

- Grand Cane

- Keachi

- Gloster

- Frierson

- Longstreet

- South Mansfield

- Stanley

Cities in Morehouse Parish where we do Mortgages:

- Bastrop

- Mer Rouge

- Collinston

- Oak Ridge

- Bonita

Cities in Plaquemines Parish where we do Mortgages:

- Belle Chasse

- Pointe à la Hache

- Port Sulphur

- Buras

- Boothville-Venice

- Empire

- Buras-Triumph

- Pilottown

- Triumph

Cities in Allen Parish where we do Mortgages:

- Oberlin

- Kinder

- Oakdale

- Reeves

- Elizabeth

Cities in Grant Parish where we do Mortgages:

- Colfax

- Dry Prong

- Pollock

- Montgomery

- Georgetown

- Creola

- Prospect

- Rock Hill

Cities in Sabine Parish where we do Mortgages:

- Many

- Zwolle

- Florien

- Pleasant Hill

- Converse

- Noble

- Fisher

- Belmont

Cities in Union Parish where we do Mortgages:

- Farmerville

- Bernice

- Marion

- Spearsville

- Lillie

Cities in Assumption Parish where we do Mortgages:

- Napoleonville

- Labadieville

- Pierre Part

- Paincourtville

- Belle Rose

- Plattenville

- Bayou L'Ourse

- Supreme

Cities in Pointe Coupee Parish where we do Mortgages:

- New Roads

- Morganza

- Livonia

- Fordoche

- Ventress

- Jarreau

- Oscar

- Lettsworth

Cities in Richland Parish where we do Mortgages:

- Rayville

- Mangham

- Delhi

- Start

Cities in St. James Parish where we do Mortgages:

- Saint James

- Lutcher

- Convent

- Gramercy

- Paulina

- Hester

- Union

- Welcome

- Moonshine

Cities in Franklin Parish where we do Mortgages:

- Winnsboro

- Wisner

- Gilbert

- Baskin

Cities in East Feliciana Parish where we do Mortgages:

- Clinton

- Jackson

- Slaughter

- Norwood

- Wilson

Cities in Concordia Parish where we do Mortgages:

- Ferriday

- Vidalia

- Clayton

- Monterey

- Ridgecrest

- Spokane

- West Ferriday

- Minorca

Cities in Jackson Parish where we do Mortgages:

- Jonesboro

- Quitman

- Chatham

- Hodge

- Eros

- North Hodge

- East Hodge

Cities in LaSalle Parish where we do Mortgages:

- Jena

- Olla

- Urania

- Trout

- Midway

Cities in Claiborne Parish where we do Mortgages:

- Homer

- Haynesville

- Athens

- Lisbon

Cities in Winn Parish where we do Mortgages:

- Winnfield

- Dodson

- Atlanta

- Sikes

- Calvin

- Saint Maurice

- Joyce

Cities in Bienville Parish where we do Mortgages:

- Bienville

- Arcadia

- Ringgold

- Gibsland

- Castor

- Saline

- Bryceland

- Mount Lebanon

- Jamestown

- Lucky

Cities in St. Helena Parish where we do Mortgages:

- Greensburg

- Montpelier

Cities in Madison Parish where we do Mortgages:

- Tallulah

- Mound

- Delta

- Richmond

Cities in West Carroll Parish where we do Mortgages:

- Oak Grove

- Kilbourne

- Epps

- Pioneer

- Forest

Cities in Caldwell Parish where we do Mortgages:

- Columbia

- Grayson

- Clarks

- Banks Springs

Cities in Catahoula Parish where we do Mortgages:

- Harrisonburg

- Jonesville

- Sicily Island

- Wallace Ridge

Cities in Red River Parish where we do Mortgages:

- Coushatta

- Hall Summit

- Martin

- Edgefield

Cities in East Carroll Parish where we do Mortgages:

- Lake Providence

Cities in Cameron Parish where we do Mortgages:

- Cameron

- Hackberry

Cities in Tensas Parish where we do Mortgages:

- Saint Joseph

- Newellton

- Waterproof

Your Louisiana 5 Star Mortgage Broker

Your Louisiana Home Loan Comparison Tool

Purchase Price

Down Payment

Down Payment Amount: $36,000

For 20% down payment, you may qualify for the following mortgage loans:

USDA Mortgage

The USDA loan is one of the best zero down payment loans still available today. Its location based meaning it has to be in a USDA approved area and eligibility is determined by household income. Many rural and suburban neighborhoods across American are eligible so it’s a perfect fit for first time and repeat home buyers that want to live in a more rural setting outside city limits.

VA Home Loan

The VA home loan is available to veterans, active military personal, and eligible spouses who have VA entitlement. It required a zero-down payment, requires no mortgage insurance, and offers flexible underwriting guidelines. It’s one of the best programs available today from an affordability standpoint and offers below market rates.

HomeReady / HomePossible

This conventional loan program assists low- to moderate-income borrowers with loans made for certain low-income areas along with more developed areas-based income eligibility. Must be a first-time homebuyer. The programs offers very flexible guidelines with a low 3% down payment and reduced mortgage insurance amounts for approved borrowers.

Conventional 97

The Conventional 97 program is a type of low-down payment mortgage for first time home buyers. There are no income limit restrictions. Borrowers only need to come up with a 3% down payment which makes it a 97% Loan to Value loan. That’s where the program gets its name. It allows for a gift for the down payment and offers common sense underwriting guidelines.

FHA Home Loan

An FHA mortgage is one of the most popular home purchase programs available today, not only for first time home buyers but repeat buyers as well. It requires a small 3.5% down payment and is perfect for borrowers with less than excellent credit, lower income, or past credit events like: foreclosure, bankruptcy, or short sale. This is a government-sponsored program designed to help more people become homeowners. That why the payments are affordable, guidelines are flexible and it offers common sense underwriting.

Conventional 95

The Standard conventional loan offers a low-down payment of 5% and offers loans up to the conventional loan limit currently $510,400. It is designed for borrowers with good to excellent credit (700 or higher) and offers attractive rates and reduced mortgage insurance. The guidelines are less restrictive for borrowers that are considered risk due to a high credit score, solid work history and a low debt to income ratio.

80-10-10

An 80-10-10 loan also known as a “piggyback loan” lets you buy a home with two mortgages that total 90% of the purchase price with only a 10% down payment. Borrowers get a first and second mortgage simultaneously: one for 80% of the purchase price, and one for 10%. One loan “piggybacks” on top of the other. This strategy avoids borrowers paying private mortgage insurance and sidesteps the strict lending requirements of jumbo loans. By taking advantage of this program the overall payment is often less than doing a traditional jumbo mortgage with offers higher interest rates and more restrictive underwriting.

Conventional Home Loan

Unlike the popular belief that 20% is required for this program you can qualify for a conventional home loan with as little as 10% down. Although mortgage insurance is required many home buyers are surprised to learn how affordable it really is with solid credit. This strategy makes sense versus coming up with a large 20% down payment to avoid mortgage insurance entirely.

Traditional Conventional Mortgage

The Traditional Conventional Mortgage option requires no private mortgage insurance (PMI) with 20% down and offers the most favorable terms including the most attractive rates. For borrowers who have a large down payment and great credit it’s the best option when purchasing your home or condo.

Multi-Unit & Investments

You can buy a duplex, triplex, or four-plex by making a down payment of 25% or more. Purchasing a multi-unit home is a great way to get your rental portfolio jump started as a landlord or as a primary residence if plan to move into one of the units and rent out the rest of the units. Whether you plan to live in one of the units or rent out the entire building this program is excellent to secure an income producing property. Homes with up to four units are eligible for the conventional mortgage program.

Find Out How Much Your Louisiana Home is Worth!

Enter your address above and and check the esimated value of your home.

Be sure to enter your email address and click "Go" to recieve your custom monthly digest.

Mortgages Explained Louisiana: Different Programs

So, you’re ready for a mortgage? Are you a first-time homebuyer or a seasoned investor? Maybe you’re ready to refinance for better rates or get cash out to update your home. No matter what your home loan needs are, you’re in good hands. We have mortgage programs for every situation.

First Time Home Buyer Mortgage

Buying a home for the first time can be a stressful and confusing situation. Where do you start? Can you afford it? The good news is we have a comprehensive list of the best loan programs that you, as a first time home buyer, can take advantage of. These programs offer different benefits depending on your unique situation and are designed to help you reach your goal of homeownership. All with less money out of your own pocket.

- Down payment as low as 3%

- Numerous programs available

- 640 credit score required

Conventional Mortgage

Conventional mortgage loans offer a unique opportunity for borrowers to become homeowners or refinance with more favorable terms. The program has stricter guidelines compared to other loan programs but can be more affordable depending on your financial situation (income, credit score, debts). You will often see down payment requirements as low as 3% – 5% in most cases. One thing you need to know about a conventional home loan is that it is not guaranteed by Uncle Sam. These loans may be a bit tougher to get and can have more stringent qualifications, but the benefit may be worth it.

- 3%-5% down payment

- Above average credit

- Low fixed payment

FHA Mortgage

The FHA loan program has been more popular than ever the last few years as credit has become harder to get. Getting an FHA loan is popular for new first-time home buyers as well as those who have been through a financial credit event like a short sale, foreclosure or other financial hardship in the past and are looking to get a mortgage to get back on track. It was created to help more borrowers realize the dream of homeownership due to its lenient underwriting guidelines and low-down payment options. Due to this, it’s considered the most flexible home loan program available today.

- 3.5% down payment

- Past credit event OK

- Low credit OK

VA Mortgage

The three core advantages of a VA Loan are that it’s specifically tailored to meet the home buying needs of veterans, current service members and military families with flexible terms. These Government backed loans make it possible for veterans to get some of the best financing available for purchasing a new home. The three main areas that benefit Veterans the most are:

- 100% financing

- Below market rates

- No mortgage insurance

Jumbo Mortgage

Jumbo Mortgages offer a unique opportunity for borrowers to buy luxury homes that exceed the conforming loan limit of $647,200. Jumbo mortgage loans have a little stricter lending requirement than other programs but still packs a punch when it comes to upping your buying power. A common misconception about jumbo loans is that you need a 20% down payment in order to qualify. The reality is jumbo financing allows you to purchase with as little as 5% to 10% down with a little creative financing. Yes, that’s right! 5% to 10% down, not the traditional 20%. This is accomplished by establishing a 1st mortgage at the conventional loan limit of $647,200 and 2nd mortgage for the rest of the balance. This “combo loan” avoids mortgage insurance and usually offers the lowest fixed payment.

- 5%-10% down payment

- 660 credit score required

- No mortgage insurance

Bank Statement Only

The program helps self-employed borrowers with write offs qualify for a home loan. Borrowers who claim their expenses for their business and reduce their adjusted gross income (AGI). It was designed to help responsible self-employed borrowers purchase a home using only bank statements instead of the traditional personal and business tax returns along with other extensive paperwork.

- 10% down payment

- Bank statement only

- No tax returns required

USDA Mortgage

The USDA Rural Development’s Single-Family Housing Guaranteed Loan Program is designed to help borrowers, low to moderate income earners purchase homes in rural areas. USDA home purchase loans are an excellent benefit for first time home buyers as well as growing families looking to upgrade their living situation. USDA loans are a very attractive 100% financing option for borrowers looking for an affordable home loan option.

- 100% financing

- Rural properties only

- 620 credit score required