It's Easier than ever to get your rate options.

Today's Florida Mortgage Rates

- Conventional

- FHA

- VA

- Jumbo

- USDA

- 30yr Fixed

- 15yr Fixed

We do Mortgages in Florida

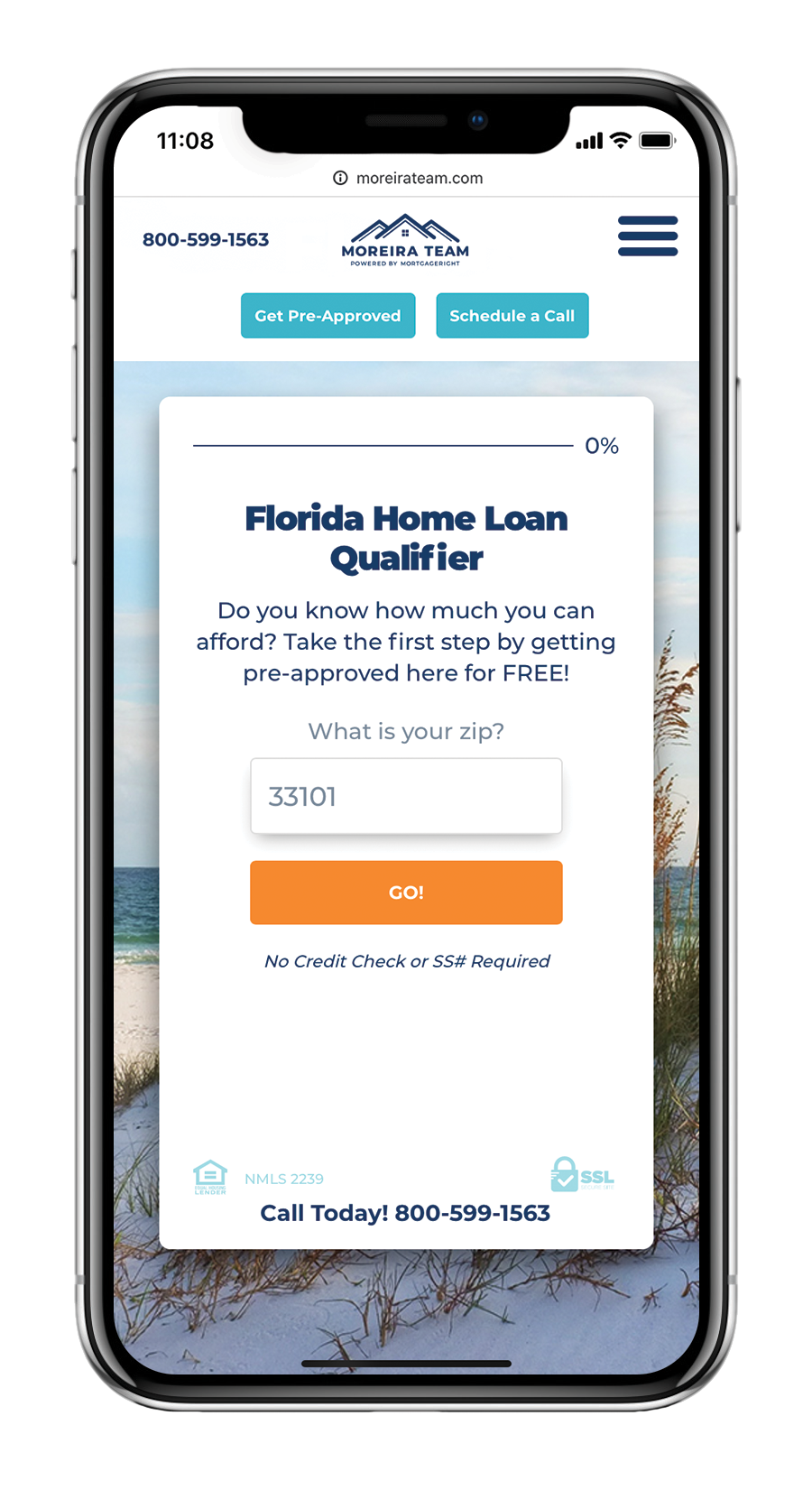

We do Mortgages in Florida. Call 800-599-1563 or fill out the form on this page for a mortgage quick quote. Its takes less than a minute to find out what you can afford.

Do you ever ask yourself, “How do I get a mortgage in Florida?” or “Who will give me a home loan in Florida?” Great News! You've found the answer with Moreira Team! We are mortgage brokers in Florida.

The mortgage process can be tedious and the time it takes can really drag out. Moreira Team, a wholesale mortgage broker in Florida, will help you get the mortgage you need at a price you can afford and in a timeline that makes sense. That’s right, we’ll make your Florida mortgage fast and easy! There’s no need to babysit the process or figure out how everything is going to get done on time, we handle it all from start to finish. Your Florida mortgage can't get any easier than this.

Let’s face it. The traditional mortgage experience is brutal.

That is why we have made it our purpose, for more than a decade, to provide our clients with the best mortgage experience possible. We have the mortgage know-how and experience to make the home loan process “done-for-you”. Getting a mortgage with us is actually a lot easier than you might think, and we have programs available for every situation. We shop your loan with over 22 different lenders and banks to make sure we deliver on our promise to get you the best deal. That means you save money, get a lower rate, and spend less money out of pocket. Our guarantee is to provide you with a transparent and easy home buying experience, and our promise is to find you the best deal.

Are you looking to buy a home?

Enter a location above to start searching for homes in your area.

Be sure to enter your email address and click "Go" to recieve your custom buyer digest for your area.

Here's a few easy steps to get started on your mortgage:

-

Step 1

Analyze Your Goals

Having a solid idea of your wants and needs is a great place to start. What are your home needs? What area do you want to live in? What is your current financial situation? What monthly payment are you conformable paying each month? -

Step 2

Have a Conversation

Call 800-599-1563 to talk to a licensed mortgage advisor to get a custom strategy on how to make your home purchase a reality. A mortgage advisor will be able to tell you exactly how much home you can afford given your unique circumstances. -

Step 3

Get Approved Fast

To get the mortgage process rolling you will want to get pre-approved. You can do this yourself by clicking below or a mortgage advisor can help you step-by-step right over the phone. It takes very little time and lets you know right away how much you are approved for. Get Pre-Approved

Find Out How Much You Can Afford (and Save!) with Our Mortgage Calculators

A mortgage calculator can help you see how much mortgage you can afford on your home. It can also help you figure out how much you can save by exploring different down payment and term options. Below we have a mortgage calculator and an affordability calculator. Feel free to play around with some numbers. And if you have any questions or want to talk more about your options give us a call or schedule a time to talk with a licensed mortgage advisor.

Florida

Mortgage Calculator

- Calculator

- Schedule

Florida

Purchase Affordability Calculator

- Purchase

- Refinance

We do mortgages in these Florida areas:

Cities in Miami-Dade County where we do Mortgages:

- Aventura

- Coral Gables

- Doral

- Florida City

- Hialeah

- Hialeah Gardens

- Homestead

- Miami

- Miami Beach

- Miami Gardens

- Miami Springs

- North Bay Village

- North Miami

- North Miami Beach

- Opa-locka

- South Miami

- Sunny Isles Beach

- Sweetwater

- West Miami

Cities in Broward County where we do Mortgages:

- Coconut Creek

- Cooper City

- Coral Springs

- Dania Beach

- Deerfield Beach

- Fort Lauderdale

- Hallandale Beach

- Hollywood

- Lauderdale Lakes

- Lauderhill

- Lighthouse Point

- Margate

- Miramar

- North Lauderdale

- Oakland Park

- Parkland

- Pembroke Pines

- Plantation

- Pompano Beach

- Sunrise

- Tamarac

- West Park

- Weston

- Wilton Manors

Cities in Palm Beach County where we do Mortgages:

- Atlantis

- Belle Glade

- Boca Raton

- Boynton Beach

- Delray Beach

- Greenacres

- Lake Worth

- Pahokee

- Palm Beach Gardens

- Riviera Beach

- South Bay

- Westlake

- West Palm Beach

Cities in Hillsborough County where we do Mortgages:

- Plant City

- Tampa

- Temple Terrace

- Apollo Beach

- Balm

- Bloomingdale

- Boyette

- Brandon

- Carrollwood

- Cheval

- Citrus Park

- Clair-Mel

- Dover

- East Lake

- Egypt Lake

- FishHawk

- Keystone

- Lake Magdalene

- Lutz

- Mango

- Northdale

- Orient Park

- Palm River

- Pebble Creek

- Progress Village

- Riverview

- Ruskin

- Seffner

- Sun City Center

- Thonotosassa

- Town ‘n’ Country

- University

- Valrico

- Westchase

- Wimauma

Cities in Orange County where we do Mortgages:

- Apopka

- Bay Lake

- Belle Isle

- Edgewood

- Lake Buena Vista

- Maitland

- Ocoee

- Orlando

- Winter Garden

- Winter Park

Cities in Pinellas County where we do Mortgages:

- Belleair Beach

- Belleair Bluffs

- Clearwater

- Dunedin

- Gulfport

- Indian Rocks Beach

- Largo

- Madeira Beach

- Oldsmar

- Pinellas Park

- Safety Harbor

- Seminole

- South Pasadena

- St. Pete Beach

- St. Petersburg

- Tarpon Springs

- Treasure Island

Cities in Duval County where we do Mortgages:

- Atlantic Beach

- Jacksonville

- Jacksonville Beach

- Neptune Beach

Cities in Lee County where we do Mortgages:

- Fort Myers

- Cape Coral

- Fort Myers Beach

- Bokeelia

- Bonita Springs

- Lehigh Acres

- Matlacha

- Saint James City

- Captiva

- Sanibel

Cities in Polk County where we do Mortgages:

- Auburndale

- Bartow

- Davenport

- Haines City

- Lakeland

- Lake Wales

- Polk City

- Winter Haven

Cities in Brevard County where we do Mortgages:

- Melbourne

- Palm Bay

- Cocoa

- Titusville

- Merritt Island

- Cocoa Beach

- Rockledge

- Satellite Beach

- Cape Canaveral

- Mims

- Port Saint John

Cities in Volusia County where we do Mortgages:

- Daytona Beach

- DeLand

- New Smyrna Beach

- Deltona

- Ormond Beach

- Port Orange

- Orange City

- DeBary

- Edgewater

- Holly Hill

Cities in Pasco County where we do Mortgages:

- New Port Richey

- Dade City

- Wesley Chapel

- Zephyrhills

- Hudson

- Land O' Lakes

- Port Richey

- Holiday

- Odessa

- Trinity

- San Antonio

- Saint Leo

- Shady Hills

- Bayonet Point

- River Ridge

- Elfers

- Lacoochee

- Crystal Springs

- Trilby

- Beacon Square

- Jasmine Estates

- Dade City North

- New Port Richey East

- Pasadena Hills

Cities in Seminole County where we do Mortgages:

- Sanford

- Lake Mary

- Altamonte Springs

- Oviedo

- Longwood

- Winter Springs

Cities in Sarasota County where we do Mortgages:

- Sarasota

- Venice

- Siesta Key

- North Port

- Nokomis

- The Meadows

- Fruitville

- Bee Ridge

- Osprey

- Gulf Gate Estates

- South Sarasota

- Sarasota Springs

- South Venice

- North Sarasota

- Warm Mineral Springs

- Southgate

- Vamo

- Laurel

- Venice Gardens

- Ridge Wood Heights

- Desoto Lakes

- Kensington Park

- South Gate Ridge

- Plantation

Cities in Manatee County where we do Mortgages:

- Bradenton

- Palmetto

- Lakewood Ranch

- Holmes Beach

- Anna Maria

- Ellenton

- Bradenton Beach

- Cortez

- West Bradenton

- Bayshore Gardens

- Whitfield

- South Bradenton

- Samoset

- West Samoset

- Memphis

Cities in Collier County where we do Mortgages:

- Naples

- Marco Island

- Immokalee

- Golden Gate

- Everglades City

- Lely

- Lely Resort

- Chokoloskee

- Goodland

- Naples Manor

- Orangetree

- Vineyards

- Verona Walk

- Plantation Island

Cities in Osceola County where we do Mortgages:

- Kissimmee

- St. Cloud

- Poinciana

- Celebration

- Yeehaw Junction

- Buena Ventura Lakes

- Campbell

Cities in Marion County where we do Mortgages:

- Ocala

- Dunnellon

- Belleview

- Silver Springs Shores

- Reddick

- McIntosh

Cities in Lake County where we do Mortgages:

- Clermont

- Leesburg

- Tavares

- Eustis

- Mount Dora

- Minneola

- Lady Lake

- Groveland

- Umatilla

- Fruitland Park

- Sorrento

- Mascotte

- Howey-in-the-Hills

- Altoona

- Montverde

- Astatula

- Grand Island

- Astor

- Yalaha

- Okahumpka

- Paisley

- Silver Lake

- Mount Plymouth

- Pine Lakes

- Lake Mack-Forest Hills

- Lisbon

- Lake Kathryn

- Ferndale

- Pittman

Cities in St. Lucie County where we do Mortgages:

- Port St. Lucie

- Fort Pierce

- Saint Lucie

- Lakewood Park

- White City

- Indian River Estates

- River Park

Cities in Escambia County where we do Mortgages:

- Pensacola

- Cantonment

- Molino

- Century

- Ferry Pass

- Bellview

Cities in Leon County where we do Mortgages:

- Tallahassee

Cities in Alachua County where we do Mortgages:

- Alachua

- Archer

- Gainesville

- High Springs

- Micanopy

Cities in St. Johns County where we do Mortgages:

- St. Augustine

- St. Augustine Beach

- Ponte Vedra Beach

- Nocatee

- Fruit Cove

- Crescent Beach

- Vilano Beach

- Hastings

- Sawgrass

- Palm Valley

- Saint Augustine Shores

- Butler Beach

Cities in Clay County where we do Mortgages:

- Orange Park

- Middleburg

- Green Cove Springs

- Fleming Island

- Keystone Heights

- Penney Farms

- Asbury Lake

- Lakeside

Cities in Okaloosa County where we do Mortgages:

- Fort Walton Beach

- Destin

- Crestview

- Niceville

- Mary Esther

- Shalimar

- Valparaiso

- Baker

Cities in Hernando County where we do Mortgages:

- Spring Hill

- Brooksville

- Weeki Wachee

- Hernando Beach

- Ridge Manor

- Brookridge

- Timber Pines

- Istachatta

- Nobleton

- Masaryktown

- Pine Island

- Lake Lindsey

- Spring Lake

- Hill 'n Dale

- High Point

Cities in Bay County where we do Mortgages:

- Panama City

- Panama City Beach

- Lynn Haven

- Callaway

- Mexico Beach

- Laguna Beach

- Springfield

- Grand Lagoon

- Pretty Bayou

- Parker

Cities in Charlotte County where we do Mortgages:

- Port Charlotte

- Punta Gorda

- Charlotte Harbor

- Rotonda West

- Manasota Key

- Harbour Heights

- Grove City

- Charlotte Park

- Solana

- Cleveland

Cities in Santa Rosa County where we do Mortgages:

- Milton

- Navarre

- Gulf Breeze

- Pace

Cities in Martin County where we do Mortgages:

- Stuart

- Palm City

- Hobe Sound

- Jensen Beach

- Indiantown

- Port Salerno

- Sewall's Point

- Jupiter Island

- Ocean Breeze

- North River Shores

- Rio

Cities in Indian River County where we do Mortgages:

- Vero Beach

- Sebastian

- Fellsmere

- Indian River Shores

- Gifford

- Wabasso

- Roseland

- Orchid

- Vero Beach South

- Winter Beach

- Florida Ridge

Cities in Citrus County where we do Mortgages:

- Inverness

- Crystal River

- Homosassa

- Lecanto

- Hernando

- Citrus Springs

- Beverly Hills

- Floral City

- Citrus Hills

- Homosassa Springs

Cities in Sumter County where we do Mortgages:

- Wildwood

- Bushnell

- Lake Panasoffkee

- Webster

- Coleman

- Center Hill

Cities in Flagler County where we do Mortgages:

- Flagler Beach

- Palm Coast

- Bunnell

- Beverly Beach

Cities in Highlands County where we do Mortgages:

- Sebring

- Avon Park

- Lake Placid

- Placid Lakes

- Sylvan Shores

Cities in Nassau County where we do Mortgages:

- Fernandina Beach

- Yulee

- Callahan

- Hilliard

Cities in Monroe County where we do Mortgages:

- Key West

- Key Largo

- Marathon

- Islamorada

- Tavernier

- Big Pine Key

- Key Colony Beach

- Cudjoe Key

- Stock Island

- Layton

- Duck Key

- North Key Largo

- Big Coppitt Key

Cities in Putnam County where we do Mortgages:

- Palatka

- Interlachen

- Crescent City

- East Palatka

- Welaka

- Pomona Park

- Bardin

Cities in Walton County where we do Mortgages:

- DeFuniak Springs

- Miramar Beach

- Freeport

- Paxton

Cities in Columbia County where we do Mortgages:

- Lake City

- Fort White

- Five Points

- Watertown

Cities in Jackson County where we do Mortgages:

- Marianna

- Sneads

- Cottondale

- Graceville

- Grand Ridge

- Greenwood

- Malone

- Campbellton

- Alford

- Bascom

- Jacob City

Cities in Gadsden County where we do Mortgages:

- Quincy

- Havana

- Chattahoochee

- Gretna

- Greensboro

- Midway

Cities in Suwannee County where we do Mortgages:

- Live Oak

- Branford

- Wellborn

Cities in Hendry County where we do Mortgages:

- Clewiston

- LaBelle

- Port LaBelle

- Montura

- Harlem

- Pioneer

Cities in Okeechobee County where we do Mortgages:

- Okeechobee

- Taylor Creek

- Cypress Quarters

Cities in Levy County where we do Mortgages:

- Williston

- Bronson

- Chiefland

- Cedar Key

- Morriston

- Yankeetown

- Inglis

- Otter Creek

- Williston Highlands

- Manattee Road

- East Bronson

- East Williston

- Andrews

Cities in DeSoto County where we do Mortgages:

- Arcadia

- Southeast Arcadia

Cities in Wakulla County where we do Mortgages:

- Sopchoppy

- Crawfordville

- Saint Marks

- Panacea

Cities in Baker County where we do Mortgages:

- Starke

- Lawtey

Cities in Bradford County where we do Mortgages:

- Starke

- Lawtey

- Hampton

- Brooker

Cities in Hardee County where we do Mortgages:

- Wauchula

- Bowling Green

- Zolfo Springs

- Ona

- Limestone

- Gardner

Cities in Washington County where we do Mortgages:

- Chipley

- Vernon

- Wausau

- Caryville

- Ebro

- Greenhead

Cities in Taylor County where we do Mortgages:

- Perry

Cities in Holmes County where we do Mortgages:

- Bonifay

- Westville

- Ponce de Leon

- Esto

- Noma

Cities in Madison County where we do Mortgages:

- Madison

- Greenville

- Lee

Cities in Gilchrist County where we do Mortgages:

- Trenton

- Bell

Cities in Dixie County where we do Mortgages:

- Cross City

- Horseshoe Beach

Cities in Gulf County where we do Mortgages:

- Port St. Joe

- Wewahitchka

Cities in Union County where we do Mortgages:

- Lake Butler

- Raiford

- Worthington Springs

Cities in Calhoun County where we do Mortgages:

- Blountstown

- Altha

Cities in Hamilton County where we do Mortgages:

- Jasper

- Jennings

- White Springs

Cities in Jefferson County where we do Mortgages:

- Monticello

- Wacissa

- Lloyd

- Aucilla

Cities in Glades County where we do Mortgages:

- Moore Haven

- Buckhead Ridge

Cities in Franklin County where we do Mortgages:

- Apalachicola

- Eastpoint

- Carrabelle

- Alligator Point

Cities in Lafayette County where we do Mortgages:

- Mayo

- Day

Cities in Liberty County where we do Mortgages:

- Bristol

- Hosford

- Lake Mystic

- Sumatra

Your Florida 5 Star Mortgage Broker

Purchase Price

Down Payment

Down Payment Amount: $36,000

For 20% down payment, you may qualify for the following mortgage loans:

USDA Mortgage

The USDA loan is one of the best zero down payment loans still available today. Its location based meaning it has to be in a USDA approved area and eligibility is determined by household income. Many rural and suburban neighborhoods across American are eligible so it’s a perfect fit for first time and repeat home buyers that want to live in a more rural setting outside city limits.

VA Home Loan

The VA home loan is available to veterans, active military personal, and eligible spouses who have VA entitlement. It required a zero-down payment, requires no mortgage insurance, and offers flexible underwriting guidelines. It’s one of the best programs available today from an affordability standpoint and offers below market rates.

HomeReady / HomePossible

This conventional loan program assists low- to moderate-income borrowers with loans made for certain low-income areas along with more developed areas-based income eligibility. Must be a first-time homebuyer. The programs offers very flexible guidelines with a low 3% down payment and reduced mortgage insurance amounts for approved borrowers.

Conventional 97

The Conventional 97 program is a type of low-down payment mortgage for first time home buyers. There are no income limit restrictions. Borrowers only need to come up with a 3% down payment which makes it a 97% Loan to Value loan. That’s where the program gets its name. It allows for a gift for the down payment and offers common sense underwriting guidelines.

FHA Home Loan

An FHA mortgage is one of the most popular home purchase programs available today, not only for first time home buyers but repeat buyers as well. It requires a small 3.5% down payment and is perfect for borrowers with less than excellent credit, lower income, or past credit events like: foreclosure, bankruptcy, or short sale. This is a government-sponsored program designed to help more people become homeowners. That why the payments are affordable, guidelines are flexible and it offers common sense underwriting.

Conventional 95

The Standard conventional loan offers a low-down payment of 5% and offers loans up to the conventional loan limit currently $510,400. It is designed for borrowers with good to excellent credit (700 or higher) and offers attractive rates and reduced mortgage insurance. The guidelines are less restrictive for borrowers that are considered risk due to a high credit score, solid work history and a low debt to income ratio.

80-10-10

An 80-10-10 loan also known as a “piggyback loan” lets you buy a home with two mortgages that total 90% of the purchase price with only a 10% down payment. Borrowers get a first and second mortgage simultaneously: one for 80% of the purchase price, and one for 10%. One loan “piggybacks” on top of the other. This strategy avoids borrowers paying private mortgage insurance and sidesteps the strict lending requirements of jumbo loans. By taking advantage of this program the overall payment is often less than doing a traditional jumbo mortgage with offers higher interest rates and more restrictive underwriting.

Conventional Home Loan

Unlike the popular belief that 20% is required for this program you can qualify for a conventional home loan with as little as 10% down. Although mortgage insurance is required many home buyers are surprised to learn how affordable it really is with solid credit. This strategy makes sense versus coming up with a large 20% down payment to avoid mortgage insurance entirely.

Traditional Conventional Mortgage

The Traditional Conventional Mortgage option requires no private mortgage insurance (PMI) with 20% down and offers the most favorable terms including the most attractive rates. For borrowers who have a large down payment and great credit it’s the best option when purchasing your home or condo.

Multi-Unit & Investments

You can buy a duplex, triplex, or four-plex by making a down payment of 25% or more. Purchasing a multi-unit home is a great way to get your rental portfolio jump started as a landlord or as a primary residence if plan to move into one of the units and rent out the rest of the units. Whether you plan to live in one of the units or rent out the entire building this program is excellent to secure an income producing property. Homes with up to four units are eligible for the conventional mortgage program.

Find Out How Much Your Florida Home is Worth!

Enter your address above and and check the esimated value of your home.

Be sure to enter your email address and click "Go" to recieve your custom monthly digest.

Mortgages Explained Florida: Different Programs

So, you’re ready for a mortgage? Are you a first-time homebuyer or a seasoned investor? Maybe you’re ready to refinance for better rates or get cash out to update your home. No matter what your home loan needs are, you’re in good hands. We have mortgage programs for every situation.

First Time Home Buyer Mortgage

Buying a home for the first time can be a stressful and confusing situation. Where do you start? Can you afford it? The good news is we have a comprehensive list of the best loan programs that you, as a first time home buyer, can take advantage of. These programs offer different benefits depending on your unique situation and are designed to help you reach your goal of homeownership. All with less money out of your own pocket.

- Down payment as low as 3%

- Numerous programs available

- 640 credit score required

Conventional Mortgage

Conventional mortgage loans offer a unique opportunity for borrowers to become homeowners or refinance with more favorable terms. The program has stricter guidelines compared to other loan programs but can be more affordable depending on your financial situation (income, credit score, debts). You will often see down payment requirements as low as 3% – 5% in most cases. One thing you need to know about a conventional home loan is that it is not guaranteed by Uncle Sam. These loans may be a bit tougher to get and can have more stringent qualifications, but the benefit may be worth it.

- 3%-5% down payment

- Above average credit

- Low fixed payment

FHA Mortgage

The FHA loan program has been more popular than ever the last few years as credit has become harder to get. Getting an FHA loan is popular for new first-time home buyers as well as those who have been through a financial credit event like a short sale, foreclosure or other financial hardship in the past and are looking to get a mortgage to get back on track. It was created to help more borrowers realize the dream of homeownership due to its lenient underwriting guidelines and low-down payment options. Due to this, it’s considered the most flexible home loan program available today.

- 3.5% down payment

- Past credit event OK

- Low credit OK

VA Mortgage

The three core advantages of a VA Loan are that it’s specifically tailored to meet the home buying needs of veterans, current service members and military families with flexible terms. These Government backed loans make it possible for veterans to get some of the best financing available for purchasing a new home. The three main areas that benefit Veterans the most are:

- 100% financing

- Below market rates

- No mortgage insurance

Jumbo Mortgage

Jumbo Mortgages offer a unique opportunity for borrowers to buy luxury homes that exceed the conforming loan limit of $647,200. Jumbo mortgage loans have a little stricter lending requirement than other programs but still packs a punch when it comes to upping your buying power. A common misconception about jumbo loans is that you need a 20% down payment in order to qualify. The reality is jumbo financing allows you to purchase with as little as 5% to 10% down with a little creative financing. Yes, that’s right! 5% to 10% down, not the traditional 20%. This is accomplished by establishing a 1st mortgage at the conventional loan limit of $647,200 and 2nd mortgage for the rest of the balance. This “combo loan” avoids mortgage insurance and usually offers the lowest fixed payment.

- 5%-10% down payment

- 660 credit score required

- No mortgage insurance

Bank Statement Only

The program helps self-employed borrowers with write offs qualify for a home loan. Borrowers who claim their expenses for their business and reduce their adjusted gross income (AGI). It was designed to help responsible self-employed borrowers purchase a home using only bank statements instead of the traditional personal and business tax returns along with other extensive paperwork.

- 10% down payment

- Bank statement only

- No tax returns required

USDA Mortgage

The USDA Rural Development’s Single-Family Housing Guaranteed Loan Program is designed to help borrowers, low to moderate income earners purchase homes in rural areas. USDA home purchase loans are an excellent benefit for first time home buyers as well as growing families looking to upgrade their living situation. USDA loans are a very attractive 100% financing option for borrowers looking for an affordable home loan option.

- 100% financing

- Rural properties only

- 620 credit score required