In this article

“Buying a home is so easy and stress-free!” Said no one ever. From the jargon to the multi-step process, there’s much to learn–especially if you’re a first-time homebuyer. The emotional rollercoaster is real, taking you from excitement to disappointment to hopefulness and everything in between.

As you begin your search, start with the basics, like finding a good realtor, researching neighborhoods, and perhaps most importantly, looking into mortgage rates in Georgia. That latter step can be a confusing one. Interest rates have made headlines in the past year, but not in a great way.

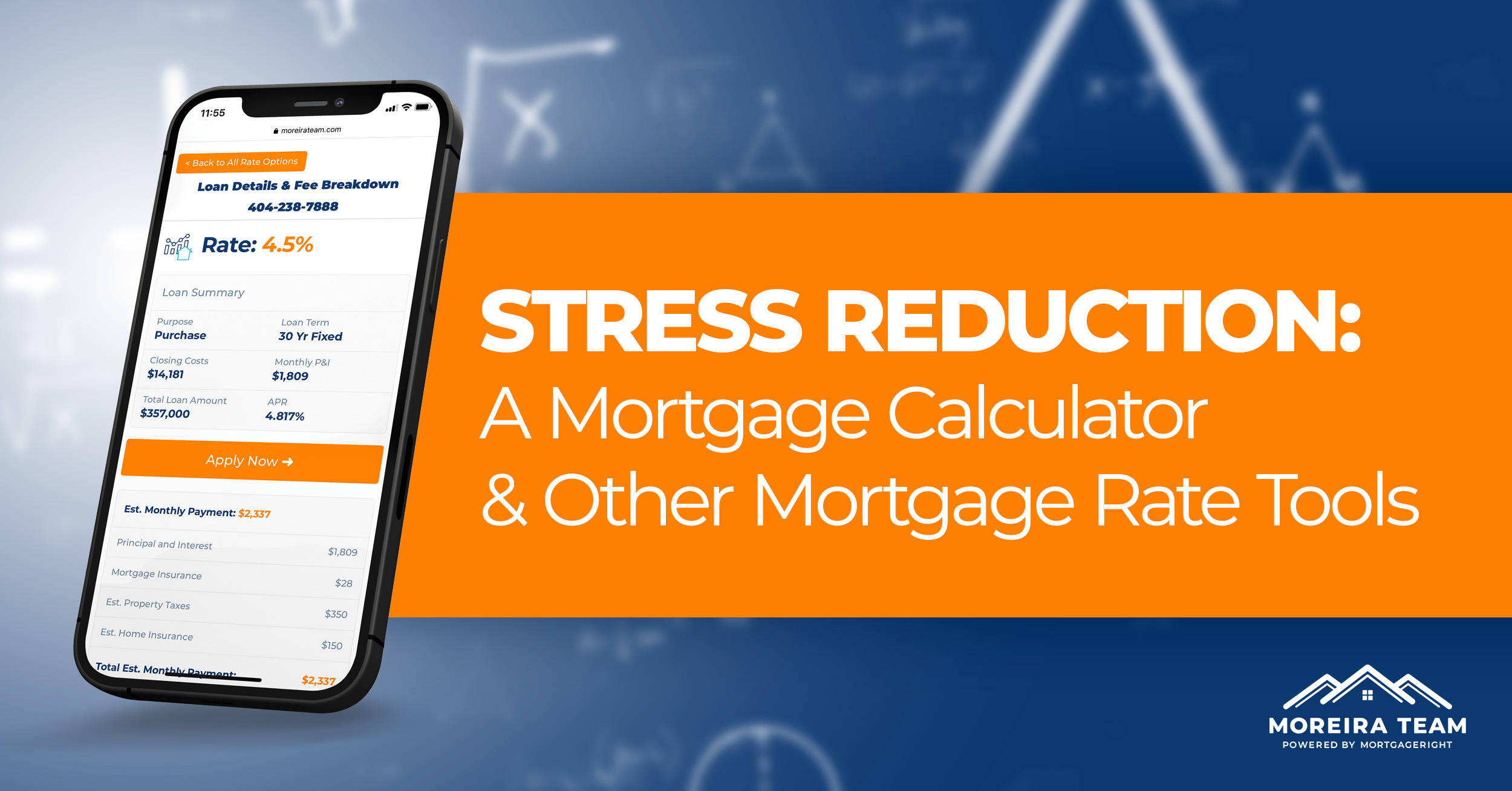

The Moreira Team is on hand to help you understand current rates, discover the best resources to help you navigate rates (like the mortgage calculator Georgia residents prefer), and learn how the right partner can help make the process as stress-free as possible.

Defining Mortgage Rates in Georgia

When you reach the stage of adulting where buying a house is an option, it’s as if you’re supposed to come pre-loaded with all the grown-up knowledge. Escrow? Due diligence? It’s like an entirely different language. For first-time homebuyers, this can feel overwhelming. So, let’s start simple. What is a mortgage rate, anyway?

A mortgage rate is the interest rate charged on a mortgage loan. It is a crucial factor in determining the total cost of a home loan over its duration. Mortgage rates can vary widely based on several factors, including your credit score, the type of loan, the loan’s duration (term), and the current market (if you’re curious, use the mortgage calculator Georgia homebuyers trust to play with the numbers).

There are two main types of mortgage rates:

Fixed Mortgage Rates: These rates remain constant for the entire loan term, providing predictability and payment stability. Regardless of market fluctuations, your interest rate and monthly principal and interest payments stay the same.

Adjustable Mortgage Rates (ARMs): These rates can change over time based on an index that reflects the cost to the lender of borrowing on the credit markets. ARMs often start with lower rates than fixed-rate mortgages but can increase or decrease, leading to changes in your monthly payment amount.

The specific rate you’re offered can depend on factors like down payment size, the home’s location, and the loan’s size compared to the home’s value (known as the loan-to-value ratio). Broader economic factors influence mortgage rates, including inflation, economic growth, and monetary policy decisions by central banks, such as the Federal Reserve in the United States.

It’s also important to note that the advertised mortgage rate is not the only cost associated with a mortgage. The Annual Percentage Rate (APR) provides a more comprehensive picture by considering the interest rate and any additional costs or fees charged by the lender.

Get your custom mortgage rate now. Start Here! (Jan 8th, 2026)Mortgage Rates 101: Soft and Hard Credit Pulls

Did your eyes glaze over? Don’t worry. You don’t have to be a number cruncher to understand and successfully navigate rates. Before you start, know that your credit history will come into play as you explore rates. Soft pulls, or soft inquiries, generally occur when a lender checks your credit for prequalification purposes.

Soft pulls do not affect your credit score because they aren’t tied to a specific application for credit. They provide a lender with limited information about your creditworthiness and are often used in the initial stages of determining what rates you might be eligible for. You might encounter soft pulls when using online rate check tools on lender websites or during the prequalification process.

Hard pulls (a.k.a. hard inquiries) happen when a lender thoroughly reviews your credit history as part of an official loan application. A hard pull can slightly lower your credit score and will stay on your credit report for up to two years. This type of inquiry is required to get a final mortgage rate and proceed with the loan application process. Hard pulls are standard when you apply for a credit card, a personal loan, or a mortgage.

Where you are in your homebuying process may determine if you want to use resources to check for mortgage rates in Georgia that require a soft versus hard pull. If you’re exploring rates and aren’t ready to apply for a mortgage yet, try our Instant Rate Quote Tool. It provides accurate rate options with NO CREDIT PULL!

If you’re ready to apply and shop around for the best rate, credit scoring models often recognize when you’re rate shopping for a specific type of loan. Suppose multiple hard inquiries for the same type of loan occur within a short period (typically 14-45 days, depending on the credit scoring model). In that case, they are usually treated as a single inquiry to calculate your credit score and minimize the impact on your credit.

Get your custom mortgage rate now. Start Here! (Jan 8th, 2026)Low-Pressure Ways to Find Mortgage Rates in Georgia

There are plenty of low-pressure ways to discover current rates and what your rate might be without doing a hard pull on your credit. One of the best ways to see what rates you may qualify for is by using our Instant Mortgage Rate Quote Tool.

Check out our custom quick quote rate table tool. No credit check required, just provide information regarding your scenario to see actual rates and closing cost options. You can see various rates, loan programs, and down payment options based on general information like loan type or location.

Try a mortgage calculator. We offer mortgage calculators to help you estimate your potential mortgage payments based on different interest rates, loan amounts, and terms. The mortgage calculator that Georgia homebuyers use can be found here. Start playing with the numbers to see how much house you can afford!

Reach out to us for a no-strings-attached inquiry. You can call or chat online with one of our mortgage advisors to discuss current rates and products. This is an easy no pressure way to get the information your looking for on your mortgage options and to get the best rates.

Quick Quote: Another Low-Pressure Option for First-Time Homebuyers

The Moreira Team is all about stress reduction in the homebuying process. While we could offer meditation or open up a smash room, our experts prefer to provide tools and resources that will make the most significant impact. Quick Quote is one of those resources. You don’t even have to talk to a human if you don’t want to (And like, who does?). This automated process won’t hit your credit and requires no social security number. Here’s how it works:

- Provide your area code.

- Indicate whether you’re interested in purchasing or refinancing a home.

- Then, answer a short series of questions that’ll give the Moreira Team more details on what you’re looking for, such as property type (primary, secondary, investment) and type of home (single-family, multi-family, etc.).

- Provide your (or your spouse’s) military status.

- Rate your credit, selecting from a set of ranges. This is not a hard pull (or even a soft pull) on your credit.

- Enter your desired purchase price and down payment.

- Fill in your contact details, and boom! You’ve got your rate options immediately, right on your screen.

It’s a fast, easy way to run the theoretical numbers on properties you’re interested in.

The Mortgage Calculator Georgia Homebuyers Can’t Get Enough Of

The Moreira Team offers additional support as you search for your dream home. This mortgage calculator will help you see how much house you can afford.

Once you’re ready to make an offer, this closing calculator can help you avoid surprises on signing day. Of course, we’re always on hand to answer any questions.

Those of you who like human contact (we see you!), reach out to schedule a consultation or get a quote now. We can help relieve the stress of homebuying by helping you find the right mortgage rate in Georgia.