In this article

From first time home buyers to experienced ones, many homebuyers enter the market with excitement but limited knowledge about the financial intricacies of purchasing a home. Often, they rely on vague estimates of their budget based on loan qualifications without a deeper understanding of their financial power. We want to help shift the focus from blindly following loan amounts to empowering homebuyers with the tools and knowledge needed to make informed mortgage decisions – and get a custom rate from one of the best mortgage companies.

Assess Your Financial Situation

Before jumping headfirst into the homebuying process, it’s crucial to pause and conduct a comprehensive evaluation of your financial situation. This assessment should encompass various aspects to ensure you’re well-prepared for the financial responsibilities that come with homeownership.

First and foremost, consider your savings, including not only the amount you have set aside for a down payment but also funds for closing costs. Down payments can range from a few to several tens of thousands of dollars, depending on the price of the home and the type of mortgage you’re seeking. Closing costs, which cover fees like appraisal, inspection, title insurance, and legal fees, can add a significant amount to your upfront expenses.

See How Easy it is to Get Your Custom Rate!Watch Now

Next, factor in ongoing costs such as property taxes and insurance. Property taxes vary widely based on location and the assessed value of your home. They are typically paid annually or semi-annually and can have a considerable impact on your monthly budget. Additionally, homeowners insurance is essential for protecting your investment and is typically required by lenders. Understanding the estimated costs of these expenses helps you gauge the affordability of homeownership in the long run.

By evaluating these upfront costs comprehensively, you gain a clearer understanding of your budgetary constraints and can make informed decisions about the type of home you can afford and the mortgage terms that suit your financial situation. This proactive approach not only helps you avoid financial strain down the road but also sets a solid foundation for a successful home buying experience.

Determine Your Comfortable Payment Range

Beyond the initial upfront costs associated with purchasing a home, it’s crucial to think about the ongoing monthly mortgage payment and its impact on your budget. This step goes hand in hand with assessing your financial standing and is essential for ensuring that homeownership remains sustainable and enjoyable over the long term.

Start by evaluating your income. Consider not just your current income but also any potential changes or fluctuations that may occur in the future. It’s important to ensure that your monthly mortgage payment aligns comfortably with your income level to avoid financial strain.

See How Easy it is to Get Your Custom Rate!Watch Now

Next, take stock of your existing debts, including credit card payments, student loans, car loans, and any other financial obligations you may have. Calculate your debt-to-income ratio, which is a measure of your monthly debt payments compared to your gross monthly income. Lenders often use this ratio to assess your ability to manage additional debt, such as a mortgage payment. Ideally, your total monthly debt payments, including your mortgage, should not exceed a certain percentage of your income to maintain financial stability.

Factor in your lifestyle expenses as well. Consider your monthly spending on groceries, utilities, transportation, entertainment, and other discretionary expenses. These costs contribute to your overall financial obligations and should be taken into account when determining how much you can comfortably afford to allocate towards your mortgage payment each month.

Explore Loan Options That Meet Your Needs

Once you have a clear understanding of your financial capabilities, the next step in the homebuying process is to explore the various loan options available to you and the best mortgage companies help you process this. Different types of loans offer varying terms, interest rates, and down payment requirements, so it’s essential to research and compare them to find the one that aligns best with your financial goals and situation and the best mortgage companies provide the most options.

Planning ahead for the cost to refinance a mortgage (or “re-fi” as the kids call it) is a financial strategy that homeowners can use to adjust their existing mortgage terms to better suit their current financial circumstances. Re-fi involves replacing an existing mortgage with a new one, often with more favorable terms such as a lower interest rate, shorter loan term, or different loan type.

By thoroughly researching and understanding the different loan options available, you can make an informed decision that best suits your financial situation and long-term homeownership goals.

See How Easy it is to Get Your Custom Rate!Watch Now

Obtain Custom Quotes from One of the Best Mortgage Companies

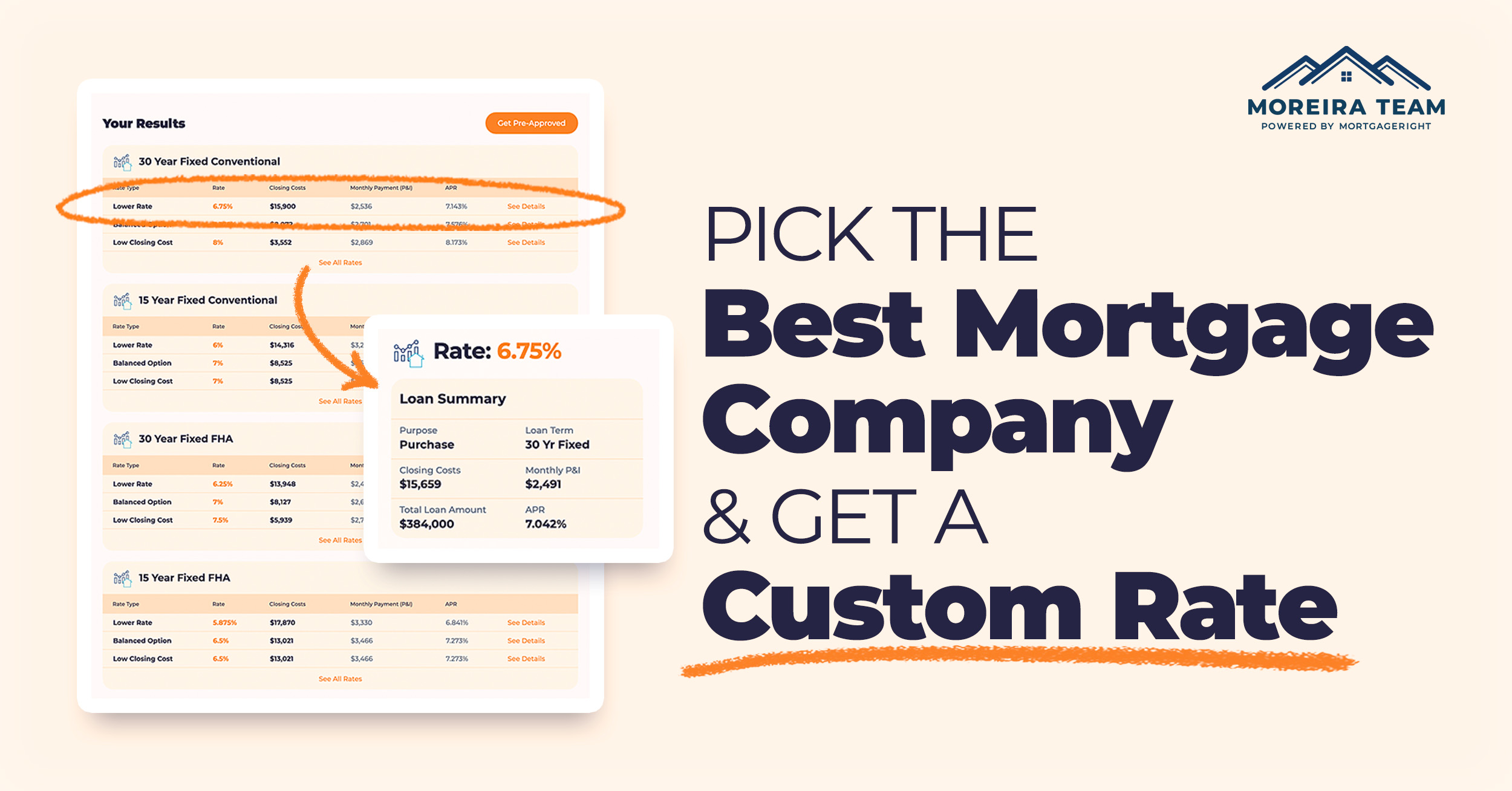

Learning about mortgage rates in Georgia can be tough. Be cautious of predatory lead-gen tools that promise rate previews but push customers into marketing funnels. Instead, opt for reputable lenders like the Moreira Team, one of the best mortgage companies. Our Custom Rate Report is different. At the end of a short questionnaire (two minutes tops), you will receive a personalized comparison chart of upfront and monthly costs across all potential loan types you qualify for. You can download, print, or share it as needed.

Step-by-Step Instructions for Your Custom Quote:

- Gather financial documents, including income statements, tax returns, and credit history.

- Contact reputable lenders, such as the Moreira Team, known for their expertise and customer-centric approach.

- Complete a short questionnaire to receive a personalized comparison chart of loan options.

- Review and compare offers, considering factors like interest rates, loan terms, and closing costs.

- Choose the loan option that best fits your needs and budget.

What You’ll Instantly Receive:

By following these steps, you’ll receive not just loan offers but also a deeper understanding of your financial standing and purchasing power. You’ll be equipped to make informed decisions that align with your long-term financial goals.

If “Just Looking,” Call Back When You’re Ready:

One of the advantages of working with one of the best mortgage companies like the Moreira Team is their commitment to assisting homebuyers at every stage. Whether you’re just exploring your options or ready to move forward, they’re there to guide you. They believe in a no-pressure approach and will contact you to follow up without resorting to hard sales pitches.

Don’t Forget About the Upfront Guarantee

For those in the initial stages of homebuying, consider starting the upfront approval guarantee process. This step can streamline your home search and provide a clear understanding of your budgetary constraints and options.

Homebuying, a pivotal financial milestone, demands informed decisions and careful planning. Regardless of your experience level, whether you’re venturing into homeownership for the first time or a seasoned buyer, thorough evaluation of your financial situation is imperative. Exploring diverse loan options, securing tailored quotes from reputable mortgage providers such as the Moreira Team, and seeking expert advice devoid of sales tactics empower you to confidently navigate the journey with less stress and a successful outcome.

Watch Now