The Impact Your Credit Score Has on Buying a Home

There are seemingly countless things to consider and responsibilities to uphold during the home-buying process. With so many factors determining whether… Read More 6 min read

These are articles related to the home buying process, the different purchase options available to a homebuyer and other helpful resources related to purchasing a a new property.

There are seemingly countless things to consider and responsibilities to uphold during the home-buying process. With so many factors determining whether… Read More 6 min read

Ready to start your house hunt but not sure how? First time homebuyers are stressed. It’s overwhelming, terrifying, exciting, and difficult… Read More 5 min read

Close-knit families across the country are taking the unconventional route when it comes to cohabitation. They’re opting to buy homes together… Read More 6 min read

The real estate market hasn’t been as friendly to the first time home buyer as of late. Between high interest rates… Read More 6 min read

If you’re a first-time home buyer, you may wonder how to make this real estate market work for you instead of… Read More 7 min read

As of 2023, close to 13% of full-time employees work from home and 16% of companies operate fully remotely. These percentages… Read More 5 min read

The Client Our client came to us with the intent of purchasing a home large enough for multiple generations. Client Requirements… Read More 2 min read

Buying a second property requires thought and careful financial planning. Timing is key. While some homeowners may feel that owning a… Read More 4 min read

For homebuyers who have Georgia on their minds, it’s easy to be dazzled by shiny, new construction, large, custom floorplans, palatial… Read More 4 min read

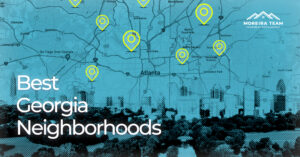

If you’re relocating to Georgia or simply looking for a new local neighborhood, there are plenty of unique communities to choose… Read More 6 min read

If you’re a first-time homebuyer, the process from pre-approval to settling into a new house can be overwhelming. As thrilling as… Read More 5 min read

Many people aspire to own a second home, and their motivations vary. Perhaps they want a retreat to escape the hustle… Read More 4 min read

Are you interested in using your second home as a source of reliable income? There are plenty of ways to do… Read More 6 min read

You may have heard the horror stories from your homeowner friends. Right when your home purchase is buttoned up, high closing… Read More 6 min read

Are you at an age where ideas like equity, assets, financial stability, and diversification are suddenly coming into focus? There’s a… Read More 6 min read

Often referred to as the Empire State of the South, Georgia is home to 10.8 million people, diverse in a myriad… Read More 5 min read

So much of what we do in life is impacted by where we live. Career, lifestyle, and overall happiness are closely… Read More 6 min read

The Client A millennial couple came to us as first-time home buyers. Client Requirement A young couple (first time home buyers)… Read More 2 min read

Are you a first time home buyer starting your journey in the world of real estate? This is a life-changing step… Read More 6 min read

Ideally, the down payment on any home purchase should be at least 20%, although recent changes in lending have resulted in… Read More 4 min read