In this article

- Key Takeaways

- Is It Finally Time to Buy?

- Housing Facts and Figures

- Prices may just be inflated… for now.

- What Influences the Market Going Forward?

- New Housing

- Built-to-Rent Communities

- Growing Areas

- Buy While Prices Are Low or Wait Until Rates Go Down?

- No-Cost Mortgage Refinance

- A Mortgage Calculator Georgia Buyers Can Rely On

- Upfront Approval Guarantee

- Do You Want to Beat the Rush?

Key Takeaways

- The Georgia real estate market is steadily gaining momentum in anticipation of lowering mortgage rates in Georgia.

- The Fed expects to lower interest rates in the fall, leading to more activity and higher prices.

- Increased inventory, new builds, and rental units could temper rising home prices in the short term.

- We’ve included a mortgage calculator Georgia residents can use to see if it’s the right time to buy.

- Upfront Approval Guarantee can help you prepare ahead of the rate drop.

- A no-cost refinance can help you buy before prices rise and reduce your rate after six months.

Is It Finally Time to Buy?

Sellers list more houses each month in preparation for falling mortgage rates in Georgia. This is a great sign for anyone purchasing a home because increased supply decreases prices.

Rates may not have fallen yet, but the increased supply could lower prices. With a mortgage calculator Georgia residents can get a better picture of the affordability of purchasing now. You can even use the one at the bottom of this market deep-dive.

Housing Facts and Figures

| January | February | March | April | May | |

| New Listings | 14,224 | 15,019 | 16,437 | 18,213 | 18,762 |

| Inventory | 26,015 | 27,211 | 28,154 | 30,444 | 33,269 |

| Days on Market | 48 | 49 | 45 | 40 | 38 |

| Median Price | $340,000 | $349,950 | $357,450 | $365,000 | $370,000 |

| Average Price | $402,107 | $414,350 | $433,713 | $444,783 | $450,168 |

In continued good news for prospective buyers, new home listings in Georgia are still rising monthly. In January, new listings increased by 14 percent, topping 14,000. That continued through May, the latest month with reported data from Georgia Realtors.

One of the biggest standouts from this year’s trend reports is the corresponding increase in listings with the decrease in days on the market. That means there is sustainably increasing activity in the housing market.

However, increased market activity can predictably bring higher prices.

Prices may just be inflated… for now.

As the market picks up, shoppers see higher and higher list prices, which can be scary. But the good news for buyers (maybe not for sellers) is that the average cost of homes sold is drastically lower than the average price of homes listed.

In counties with the most activity, buyers can expect to see six-figure differences between the average list and average sale price.

The discrepancy doesn’t necessarily mean sellers accept $100,000 less for their houses. In many cases, it’s simply an indicator of the lower-priced inventory selling much faster. Either way, it’s a sign that buyers aren’t ready to participate in a more expensive marketplace.

While the lower sale price was consistent in almost every Georgia county in May, the range and geography were all over the place. DeKalb County has practically no variance, and the difference in Hall County (right down the road) is more than $200,000, list over sale.

Either way, this likely won’t last once mortgage rates drop later this year. Using a mortgage calculator Georgia residents can use these figures to estimate their potential mortgage payments.

What Influences the Market Going Forward?

No one knows what happens next. However, we can make some guesses based on trends and past housing market behavior.

New Housing

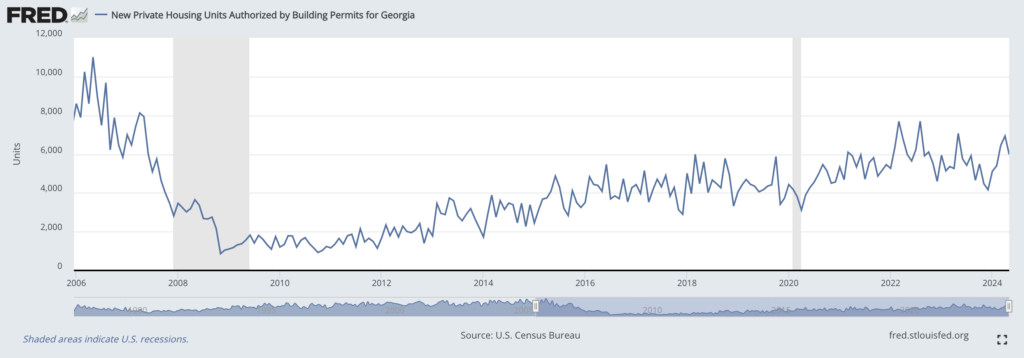

According to the Federal Reserve Bank, new housing permits were slightly down in May compared to April but are trending up overall compared to the previous decade. More housing availability is better for everyone in the market.

An injection of existing inventory and new builds will help keep already high prices under control as rates lower at the end of 2025.

Built-to-Rent Communities

In 2023, Atlanta had the third-highest number of built-to-rent communities in the U.S., more than 3,500 from 2018-2023.

Sure, those units could have been made available on the already tight purchase market. Still, they will help to accommodate many of the growing numbers of people moving to Georgia’s most popular neighborhoods.

More people moving into built-to-rent communities means fewer people trying to outbid you on your next house. Like new housing, these built-to-rent units could help temper the market when the Fed finally cuts interest rates.

Growing Areas

Areas with the most growth include counties in the greater Atlanta, Athens, and Savannah areas, with Atlanta leading the way. Gwinnett, Fulton, Cobb, and DeKalb counties had only 500 or more sales in May.

Clarke County and the surrounding Athens area are seeing higher rates of listing and sales. Houston and Bibb counties, near Robins Air Force Base, also see increased real estate market activity.

As market activity increases, it will likely continue to rise in these counties and metro areas fastest, meaning they have more options and likely higher prices.

Using a mortgage calculator, Georgia residents can estimate the differing costs of buying in these growing areas.

Buy While Prices Are Low or Wait Until Rates Go Down?

Georgia had over 60,000 homes on the market before 2017, which dropped as low as 14,000 during the summer 2020 pandemic purchasing panic.

Home prices have remained relatively high in the intervening years because inventory hasn’t reached pre-pandemic, and housing demand continues to outpace supply in Georgia and nationwide.

Most homeowners wouldn’t call the current prices low. However, the pent-up demand in the marketplace will likely lead to price spikes once interest rates drop in the fall (possibly again in 2025). Based on past performance and current market trends, prices will likely be lower now than next year.

No-Cost Mortgage Refinance

One option buyers have is to purchase a home now at a higher rate with the intention of refinancing after the rate drops. The six-month waiting period for refinancing a new mortgage will align fairly evenly with the projected rate decrease for anyone purchasing a home this spring or summer.

In the long run, buying a house at a lower price today and then refinancing in the next year is less expensive in the long run than taking out a much larger mortgage.

All that said, there are no guarantees in the housing market, and prices could go down tomorrow.

A Mortgage Calculator Georgia Buyers Can Rely On

Keeping track of all the different market factors can be a nightmare. Plus, mortgage rates, loan program availability, and monthly taxes vary from institution to institution and state to state. So, the Moreira Team built a mortgage calculator Georgia home buyers can rely on.

Adjust your price, down payment, interest rate, and loan term to get an estimate of your monthly mortgage payment.

Upfront Approval Guarantee

Some lenders have access to underwriting tools, like the upfront approval guarantee, which can guarantee you a loan amount for up to 120 days before you ever find a house or make an offer.

Most lenders offer a cursory pre-approval, but the borrower must still apply and officially qualify for the loan. With an upfront approval guarantee, you can complete all of your

The Upfront Approval Guarantee verifies tax statements, credit scores, bank records, income, assets, and debt-to-income ratio so your loan is as close to guaranteed as possible. This also allows you to waive the financing contingency and strengthen your offer once other buyers flood the market.

Do You Want to Beat the Rush?

The Moreira Team doesn’t believe in pushing people into homes they don’t love or loans they can’t afford. Our lenders work with buyers to prepare in advance, put together a competitive offer, and close on time.

Preparation can look as simple as asking our team a few questions to get you started or getting you upfront approval so you’re ready when the market hits your sweet spot.

Reach out to get started.