It's Easier than ever to get your rate options.

Today's Pennsylvania Mortgage Rates

We do Mortgages in Pennsylvania

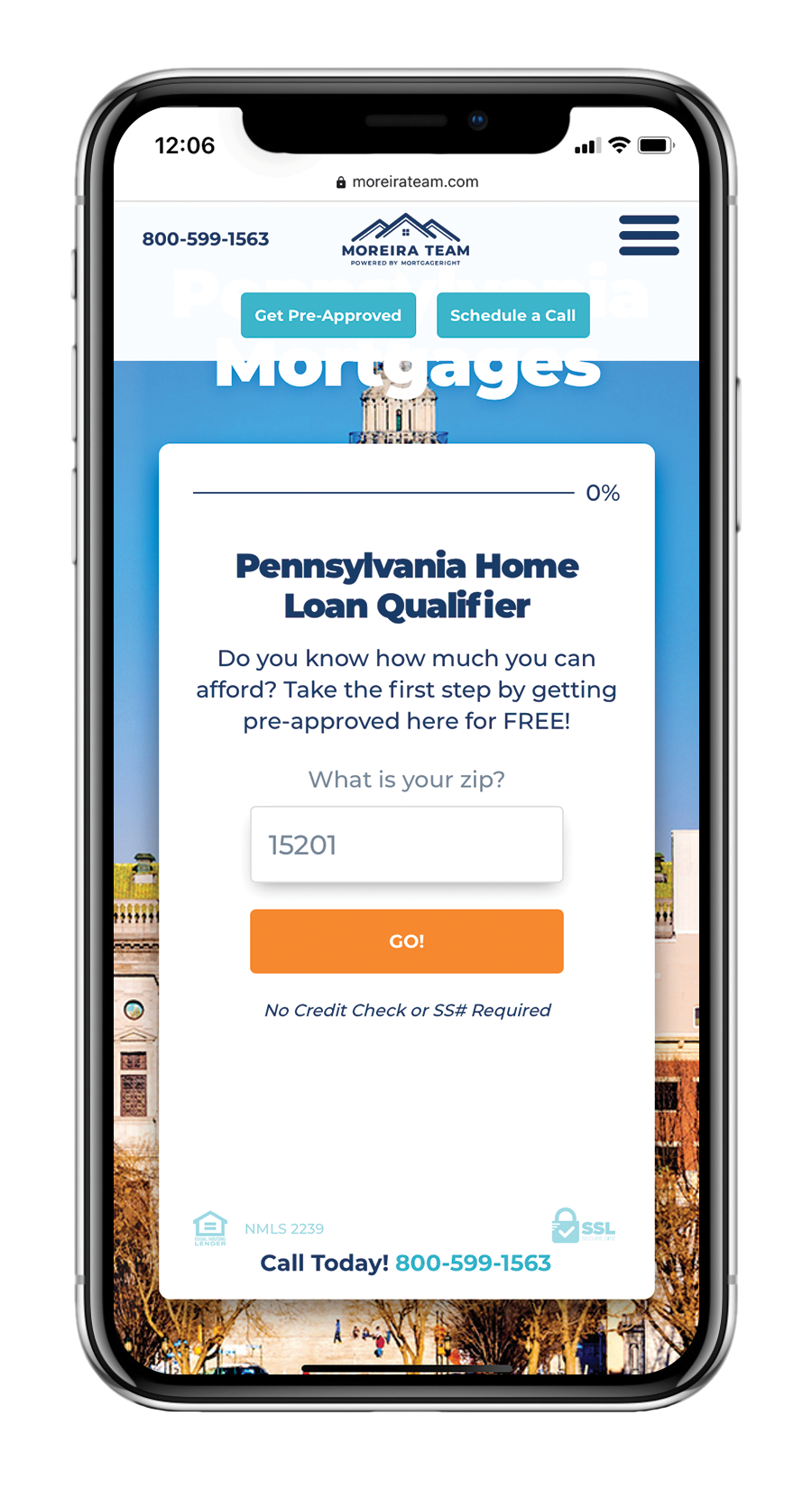

We do Mortgages in Pennsylvania. Call 800-599-1563 or fill out the form on this page for a mortgage quick quote. Its takes less than a minute to find out what you can afford.

Do you ever ask yourself, “How do I get a mortgage in Pennsylvania?” or “Who will give me a home loan in Pennsylvania?” Great News! You've found the answer with Moreira Team! We are mortgage brokers in Pennsylvania.

The mortgage process can be tedious and the time it takes can really drag out. Moreira Team, a wholesale mortgage broker in Pennsylvania, will help you get the mortgage you need at a price you can afford and in a timeline that makes sense. That’s right, we’ll make your Pennsylvania mortgage fast and easy! There’s no need to babysit the process or figure out how everything is going to get done on time, we handle it all from start to finish. Your Pennsylvania mortgage can't get any easier than this.

Let’s face it. The traditional mortgage experience is brutal.

That is why we have made it our purpose, for more than a decade, to provide our clients with the best mortgage experience possible. We have the mortgage know-how and experience to make the home loan process “done-for-you”. Getting a mortgage with us is actually a lot easier than you might think, and we have programs available for every situation. We shop your loan with over 22 different lenders and banks to make sure we deliver on our promise to get you the best deal. That means you save money, get a lower rate, and spend less money out of pocket. Our guarantee is to provide you with a transparent and easy home buying experience, and our promise is to find you the best deal.

Are you looking to buy a home?

Enter in your city above to start searching for homes in your area.

Here's a few easy steps to get started on your mortgage:

-

Step 1

Analyze Your Goals

Having a solid idea of your wants and needs is a great place to start. What are your home needs? What area do you want to live in? What is your current financial situation? What monthly payment are you conformable paying each month? -

Step 2

Have a Conversation

Call 800-599-1563 to talk to a licensed mortgage advisor to get a custom strategy on how to make your home purchase a reality. A mortgage advisor will be able to tell you exactly how much home you can afford given your unique circumstances. -

Step 3

Get Approved Fast

To get the mortgage process rolling you will want to get pre-approved. You can do this yourself by clicking below or a mortgage advisor can help you step-by-step right over the phone. It takes very little time and lets you know right away how much you are approved for. Get Pre-Approved

Find Out How Much You Can Afford (and Save!) with Our Mortgage Calculators

A mortgage calculator can help you see how much mortgage you can afford on your home. It can also help you figure out how much you can save by exploring different down payment and term options. Below we have a mortgage calculator and an affordability calculator. Feel free to play around with some numbers. And if you have any questions or want to talk more about your options give us a call or schedule a time to talk with a licensed mortgage advisor.

Pennsylvania

Mortgage Calculator

- Calculator

- Schedule

Pennsylvania

Purchase Affordability Calculator

- Purchase

- Refinance

We do mortgages in these Pennsylvania areas:

Cities in Philadelphia County where we do Mortgages:

- Philadelphia

- Kingsessing Township

- Germantown Borough

- Passyunk Township

- Southwark District

- Bristol Township

- Byberry Township

- Moyamensing District

- Aramingo Borough

- Germantown Township

- Belmont District

- Northern Liberties Township

- Richmond District

- Frankford Borough

- Penn Township

- Oxford Township

- Roxborough Township

- Whitehall Borough

- Moreland Township

- West Philadelphia Borough

- Penn District

- Kensington District

- Spring Garden District

- Bridesburg Borough

- Manayunk Borough

- Delaware Township

- Blockley Township

- Lower Dublin Township

- Northern Liberties District

Cities in Allegheny County where we do Mortgages:

- Pittsburgh

- Monroeville

- Bethel Park

- Mount Lebanon

- Sewickley

- McKeesport

- Upper Saint Clair

- Moon Township

- Penn Hills

- South Park Township

- West Mifflin

- Gibsonia

- Carnegie

- Coraopolis

- Plum

- Fox Chapel

- McKees Rocks

- Bridgeville

- McCandless

- Ross Township

- Oakmont

- Tarentum

- Clairton

- Pleasant Hills

- Wilkinsburg

- Munhall

- Baldwin

- Dormont

- Braddock

- Duquesne

- Jefferson Hills

- North Versailles

- Homestead

- Brentwood

- Elizabeth

- Swissvale

- Turtle Creek

- Forest Hills

- Millvale

- East Pittsburgh

- Sharpsburg

- Crafton

- Cheswick

- Etna

- Castle Shannon

- Franklin Park

- Oakdale

- O'Hara Township

- Aspinwall

- Springdale

- White Oak

Cities in Montgomery County where we do Mortgages:

- Norristown

- Lansdale

- Pottstown

- King of Prussia

- Blue Bell

- Collegeville

- North Wales

- Ambler

- Conshohocken

- Horsham

- Plymouth Meeting

- Willow Grove

- Montgomeryville

- Jenkintown

- Harleysville

- Glenside

- Souderton

- Royersford

- Bryn Mawr

- Hatboro

- Hatfield

- Gilbertsville

- East Norriton

- Pennsburg

- Green Lane

- Schwenksville

- Skippack

- Eagleville

- Bridgeport

- Fort Washington

- Narberth

- Audubon

- Wynnewood

- Lafayette Hill

- West Norriton

- Gladwyne

- Trappe

- West Conshohocken

- East Greenville

- Wyncote

- Flourtown

- Oreland

- Rockledge

- Wyndmoor

- Bryn Athyn

- Red Hill

- Sanatoga

- Pottsgrove

- Dresher

- Spring House

- Spring Mount

Cities in Bucks County where we do Mortgages:

- Doylestown

- New Hope

- Buckingham Township

- Newtown

- Levittown

- Langhorne

- Quakertown

- Warminster

- Yardley

- Bensalem Township

- Bristol

- Perkasie

- Chalfont

- Feasterville-Trevose

- Morrisville

- Fairless Hills

- Richboro

- Sellersville

- Middletown Township

- Jamison

- Northampton Township

- Warwick Township

- Tinicum

- Ivyland

- Lower Southampton Township

- Doylestown Township

- Upper Southampton Township

- Riegelsville

- Penndel

- New Britain

- New Britain Township

- Plumstead Township

- Wrightstown Township

- Croydon

- Plumsteadville

- Tullytown

- Hulmeville

- Trumbauersville

- Churchville

- Dublin

- Silverdale

- Richlandtown

- Newtown Grant

- Langhorne Manor

- Village Shires

- Spinnerstown

- Milford Square

- Brittany Farms-Highlands

- Woodbourne

- Woodside

- Eddington

Cities in Delaware County where we do Mortgages:

- Springfield

- Media

- Chester

- Aston

- Newtown Square

- Drexel Hill

- Broomall

- Swarthmore

- Folcroft

- Lansdowne

- Glenolden

- Ridley Park

- Brookhaven

- Darby

- Sharon Hill

- Garnet Valley

- Collingdale

- Clifton Heights

- Upper Chichester

- Prospect Park

- Yeadon

- Aldan

- Folsom

- Norwood

- Tinicum Township

- Marcus Hook

- Boothwyn

- Chadds Ford Township

- Upland

- Darby Township

- Eddystone

- Morton

- Nether Providence Township

- Chester Township

- Chester Heights

- Woodlyn

- Colwyn

- East Lansdowne

- Rose Valley

- Trainer

- Linwood

- Millbourne

- Parkside

- Lima

- Rutledge

Cities in Lancaster County where we do Mortgages:

- Lancaster

- Lititz

- Ephrata

- Manheim

- Strasburg

- Mount Joy

- New Holland

- Elizabethtown

- Bird in Hand

- Millersville

- Columbia

- Willow Street

- Ronks

- Intercourse

- Quarryville

- Mountville

- East Petersburg

- Denver

- Marietta

- Akron

- Gordonville

- Conestoga

- Lampeter

- Gap

- Adamstown

- Paradise

- East Earl

- Narvon

- New Providence

- Terre Hill

- Stevens

- Holtwood

- Brownstown

- Christiana

- Salunga-Landisville

- Smoketown

- Blue Ball

- Washington Boro

- Ephrata Township

- Reinholds

- Bowmansville

- Kinzers

- Bainbridge

- Reamstown

- Nickel Mines

- Brickerville

- Refton

- Witmer

- Fivepointville

- Soudersburg

- Swartzville

Cities in Chester County where we do Mortgages:

- West Chester

- Exton

- Downingtown

- Coatesville

- Kennett Square

- Phoenixville

- Malvern

- Chester Springs

- Oxford

- Paoli

- West Grove

- Honey Brook

- Parkesburg

- Berwyn

- Spring City

- Devon

- Avondale

- Elverson

- Thorndale

- Landenberg

- Cochranville

- Atglen

- Lionville

- Chesterbrook

- Eagle

- Birchrunville

- Toughkenamon

- South Coatesville

- Caln

- Modena

- South Pottstown

- Kenilworth

- Pomeroy

- Westwood

Cities in York County where we do Mortgages:

- York

- Hanover

- Red Lion

- New Salem Borough

- Dallastown

- Dover

- Spring Grove

- Shrewsbury

- Dillsburg

- West York

- East York

- Manchester

- New Freedom

- Wrightsville

- Glen Rock

- Goldsboro

- Stewartstown

- Lewisberry

- York Haven

- Mount Wolf

- Seven Valleys

- Felton

- Delta

- Thomasville

- North York

- Loganville

- Emigsville

- Hallam

- Windsor

- Shiloh

- Wellsville

- Jacobus

- East Prospect

- Jefferson

- Yoe

- Fawn Grove

- Susquehanna Trails

- Yorkana

- Weigelstown

- Franklintown

- Cross Roads

- Winterstown

- Valley Green

- Grantley

- Spry

- New Market

- Pennville

- Valley View

- Tyler Run-Queens Gate

- Parkville

- Railroad

Cities in Berks County where we do Mortgages:

- Reading

- Wyomissing

- Kutztown

- Hamburg

- Boyertown

- Sinking Spring

- Birdsboro

- Fleetwood

- Oley

- Leesport

- Shillington

- Douglassville

- West Reading

- Mohnton

- Bernville

- Wernersville

- Temple

- Robesonia

- Blandon

- Morgantown

- Mertztown

- West Lawn

- Mount Penn

- Womelsdorf

- Laureldale

- Shoemakersville

- Topton

- Bechtelsville

- Kenhorst

- Lenhartsville

- Bethel

- Shartlesville

- Strausstown

- Kempton

- Bally

- Mohrsville

- Virginville

- Saint Lawrence

- Lyons

- New Berlinville

- Centerport

- Stouchsburg

- Lincoln Park

- Flying Hills

- Lorane

- Stony Creek Mills

- Rehrersburg

- Jacksonwald

- Reiffton

- Gouglersville

- New Morgan

Cities in Lehigh County where we do Mortgages:

Cities in Westmoreland County where we do Mortgages:

- Allentown

- Emmaus

- Macungie

- Coopersburg

- Trexlertown

- Schnecksville

- Slatington

- Catasauqua

- Coplay

- New Tripoli

- Fountain Hill

- Alburtis

- Wescosville

- Laurys Station

- East Texas

- Hokendauqua

- Slatedale

- Fullerton

- Ancient Oaks

- Stiles

Cities in Luzerne County where we do Mortgages:

- Luzerne

- Wilkes-Barre

- Hazleton

- Dallas

- Kingston

- Pittston

- Nanticoke

- Mountain Top

- Exeter

- White Haven

- Plymouth

- Wyoming

- Larksville

- Shavertown

- Forty Fort

- Swoyersville

- Harveys Lake

- Duryea

- Wilkes-Barre Township

- Shickshinny

- Edwardsville

- Avoca

- West Hazleton

- Conyngham

- Plains

- West Wyoming

- Freeland

- Back Mountain

- Ashley

- Laflin

- Sugar Notch

- Hughestown

- Nescopeck

- Glen Lyon

- Courtdale

- Dupont

- Bear Creek Village

- Nuangola

- Warrior Run

- Laurel Run

- Trucksville

- Yatesville

- Pringle

- Mocanaqua

- West Nanticoke

- Jeddo

- Beech Mountain Lakes

- Penn Lake Park

- Hilldale

- Pardeesville

- East Berwick

Cities in Northampton County where we do Mortgages:

- Northampton

- Easton

- Nazareth

- Bangor

- Wind Gap

- Bath

- Pen Argyl

- Walnutport

- Hellertown

- Wilson

- Freemansburg

- Cherryville

- Stockertown

- Tatamy

- West Easton

- North Catasauqua

- Danielsville

- Roseto

- East Bangor

- Portland

- Martins Creek

- Glendon

- Palmer Heights

- Eastlawn Gardens

- Old Orchard

- Belfast

- Middletown

- Chapman

Cities in Dauphin County where we do Mortgages:

- Harrisburg

- Dauphin

- Hershey

- Middletown

- Hummelstown

- Millersburg

- Halifax

- Steelton

- Elizabethville

- Lykens

- Highspire

- Gratz

- Berrysburg

- Linglestown

- Paxtang

- Williamstown

- Penbrook

- Wiconisco

- Royalton

- Colonial Park

- Paxtonia

- Pillow

- Union Deposit

- Progress

- Rutherford

- Lawnton

- Lenkerville

- Skyline View

- Palmdale

Cities in Erie County where we do Mortgages:

- Erie

- North East

- Edinboro

- Girard

- Corry

- Waterford

- McKean

- Union City

- Wattsburg

- Lawrence Park

- Albion

- Mill Village

- Wesleyville

- Lake City

- Cranesville

- Northwest Harborcreek

- Avonia

- Platea

- Elgin

Cities in Cumberland County where we do Mortgages:

- Carlisle

- Mechanicsburg

- Camp Hill

- New Cumberland

- Newville

- Lemoyne

- Newburg

- Enola

- Mount Holly Springs

- Boiling Springs

- Wormleysburg

- Shiremanstown

- New Kingstown

- Lower Allen

- West Fairview

- Plainfield

- Schlusser

Cities in Lackawanna County where we do Mortgages:

- Scranton

- Dunmore

- Clarks Summit

- Old Forge

- Carbondale

- Dickson City

- Moosic

- Olyphant

- Archbald

- Taylor

- Jessup

- Moscow

- Dalton

- Mayfield

- Throop

- Jermyn

- Clarks Green

- Blakely

- Vandling

- Simpson

- Chinchilla

- Mount Cobb

- Glenburn

Cities in Washington County where we do Mortgages:

- Washington

- Canonsburg

- McMurray

- Charleroi

- Monongahela

- Finleyville

- Burgettstown

- Eighty Four

- California

- Claysville

- Venetia

- Bentleyville

- Meadowlands

- Fredericktown

- Donora

- West Alexander

- Centerville

- Hickory

- Avella

- Houston

- East Washington

- Beallsville

- New Eagle

- Coal Center

- Marianna

- Allenport

- North Charleroi

- Cokeburg

- Speers

- West Brownsville

- West Middletown

- Ellsworth

- Langeloth

- Bulger

- Roscoe

- Elco

- Dunlevy

- Green Hills

- Slovan

- Atlasburg

- Cecil-Bishop

- Midway

- Wolfdale

- Deemston

- Elrama

- Lawrence

- Millsboro

- Gastonville

- Wickerham Manor-Fisher

- Wylandville

- Baidland

Cities in Butler County where we do Mortgages:

- Butler

- Cranberry Township

- Slippery Rock

- Mars

- Saxonburg

- Zelienople

- Chicora

- Evans City

- Valencia

- Harmony

- Prospect

- Meridian

- Karns City

- Connoquenessing

- East Butler

- Harrisville

- Portersville

- West Sunbury

- Seven Fields

- Homeacre-Lyndora

- Bruin

- Callery

- Petrolia

- Eau Claire

- Oak Hills

- West Liberty

- Fairview

- Shanor-Northvue

- Cherry Valley

- Lake Arthur Estates

- Nixon

Cities in Monroe County where we do Mortgages:

- Stroudsburg

- East Stroudsburg

- Tobyhanna

- Mount Pocono

- Saylorsburg

- Pocono Pines

- Brodheadsville

- Effort

- Pocono Summit

- Delaware Water Gap

- Reeders

- Mountainhome

- Penn Estates

- Arlington Heights

- Sierra View

Cities in Beaver County where we do Mortgages:

- Beaver

- Beaver Falls

- Aliquippa

- Monaca

- Ambridge

- New Brighton

- Rochester

- Baden

- Midland

- Freedom

- Industry

- Darlington

- Bridgewater

- Economy

- Big Beaver

- Shippingport

- Koppel

- Hookstown

- New Galilee

- Ohioville

- Conway

- Patterson Township

- Patterson Heights

- South Heights

- Fallston

- Harmony Township

- West Mayfield

- Georgetown

- Eastvale

- East Rochester

- Frankfort Springs

- Homewood

- Glasgow

Cities in Centre County where we do Mortgages:

- State College

- Bellefonte

- Centre Hall

- Philipsburg

- Boalsburg

- Howard

- Pleasant Gap

- Milesburg

- Spring Mills

- Millheim

- Port Matilda

- Snow Shoe

- Lemont

- Moshannon

- Pine Grove Mills

- Rebersburg

- Julian

- Aaronsburg

- Unionville

- Stormstown

- Sandy Ridge

- Madisonburg

- Houserville

- Toftrees

- Coburn

- Zion

- Clarence

- Blanchard

- Hublersburg

- Woodward

- Park Forest Village

- Orviston

- Mount Eagle

- North Philipsburg

- Pine Glen

- Ramblewood

- Monument

Cities in Franklin County where we do Mortgages:

- State Line

- Chambersburg

- Waynesboro

- Greencastle

- Mercersburg

- Fayetteville

- Mont Alto

- Fort Loudon

- Scotland

- Orrstown

- Blue Ridge Summit

- Marion

- Rouzerville

- Wayne Heights

- Guilford

- Cove Gap

Cities in Lebanon County where we do Mortgages:

- Lebanon

- Palmyra

- Annville

- Myerstown

- Jonestown

- Cornwall

- Lebanon South

- Mount Gretna

- Fredericksburg

- Cleona

- Schaefferstown

- Newmanstown

- Campbelltown

- Richland

- Pleasant Hill

- Avon

- Sand Hill

- Mount Gretna Heights

- Harper Tavern

- Timber Hills

Cities in Schuylkill County where we do Mortgages:

- Pottsville

- Schuylkill Haven

- Tamaqua

- Frackville

- Orwigsburg

- Shenandoah

- Pine Grove

- Minersville

- Ashland

- Saint Clair

- Auburn

- New Ringgold

- Tower City

- Coaldale

- Mahanoy City

- Tuscarora

- Cressona

- McAdoo

- Girardville

- Port Carbon

- Tremont

- Ringtown

- Hegins

- Lake Wynonah

- Barnesville

- New Philadelphia

- Gilberton

- Mount Carbon

- Valley View

- Port Clinton

- Landingville

- Friedensburg

- Middleport

- Cumbola

- Deer Lake

- Gordon

- Palo Alto

- Fountain Springs

- Marlin

- Nuremberg

- Shenandoah Heights

- Hometown

- Branchdale

- Kelayres

- Sheppton

- Mechanicsville

- Union Township

- Summit Station

- Altamont

- Brandonville

- Seltzer

Cities in Cambria County where we do Mortgages:

- Johnstown

- Ebensburg

- Northern Cambria

- Cresson

- Nanty-Glo

- Patton

- Loretto

- Portage

- Carrolltown

- Westmont

- South Fork

- Gallitzin

- Summerhill

- Ferndale

- Hastings

- Sidman

- Ashville

- Wilmore

- East Conemaugh

- Southmont

- Scalp Level

- Lilly

- Vintondale

- Daisytown

- Colver

- Revloc

- Beaverdale

- Lorain

- Dale

- Dunlo

- Chest Springs

- Ehrenfeld

- Salix

- Mundys Corner

- Sankertown

- Vinco

- Blandburg

- Cassandra

- Elim

Cities in Fayette County where we do Mortgages:

- Uniontown

- Connellsville

- Belle Vernon

- Masontown

- Smithfield

- Perryopolis

- Fayette City

- Dunbar

- Fairchance

- Springfield Township

- Brownsville

- Ohiopyle

- Farmington

- Point Marion

- Hopwood

- Lemont Furnace

- New Salem

- South Connellsville

- Dawson

- Markleysburg

- Vanderbilt

- Grindstone

- Smock

- Chalkhill

- Republic

- Newell

- Allison

- Hiller

- Everson

- Oliver

- Ronco

- Buffington

- East Uniontown

- Leith-Hatfield

Cities in Blair County where we do Mortgages:

- Altoona

- Hollidaysburg

- Duncansville

- Tyrone

- Roaring Spring

- Martinsburg

- Bellwood

- Williamsburg

- Claysburg

- East Freedom

- Newry

- Tipton

- Foot of Ten

- Grazierville

Cities in Lycoming County where we do Mortgages:

- Williamsport

- Muncy

- Montoursville

- Hughesville

- Montgomery

- South Williamsport

- Jersey Shore

- Duboistown

- Picture Rocks

- Salladasburg

- Warrensville

- Garden View

Cities in Mercer County where we do Mortgages:

- Mercer

- Grove City

- Sharon

- Hermitage

- Greenville

- Sharpsville

- Farrell

- West Middlesex

- Sandy Lake

- Stoneboro

- Fredonia

- Jamestown

- Jackson Center

- Wheatland

- Sheakleyville

- Clark

- Lake Latonka

- New Lebanon

Cities in Adams County where we do Mortgages:

- Gettysburg

- Littlestown

- Biglerville

- East Berlin

- Fairfield

- New Oxford

- McSherrystown

- Abbottstown

- York Springs

- Arendtsville

- Bendersville

- Orrtanna

- Carroll Valley

- Aspers

- Cashtown

- Bonneauville

- Gardners

- Hunterstown

- Heidlersburg

- Lake Heritage

- Hampton

- Idaville

- Floradale

- Table Rock

- Midway

Cities in Northumberland County where we do Mortgages:

- Northumberland

- Sunbury

- Shamokin

- Elysburg

- Milton

- Mount Carmel

- Watsontown

- Kulpmont

- Herndon

- Turbotville

- Trevorton

- Marion Heights

- Riverside

- Snydertown

- Montandon

- Paxinos

- McEwensville

- Dalmatia

- Locust Gap

- Atlas

- Dewart

- Kapp Heights

- Edgewood

- Marshallton

- Fairview-Ferndale

Cities in Lawrence County where we do Mortgages:

- New Castle

- New Wilmington

- Wampum

- Volant

- Bessemer

- New Beaver

- Enon Valley

- Ellport

- West Pittsburg

- South New Castle

- New Bedford

- S.N.P.J.

- Oakwood

- Frizzleburg

- New Castle Northwest

- Oakland

Cities in Crawford County where we do Mortgages:

- Meadville

- Conneaut Lake

- Titusville

- Saegertown

- Linesville

- Cochranton

- Cambridge Springs

- Conneautville

- Townville

- Springboro

- Centerville

- Spartansburg

- Venango

- Guys Mills

- Conneaut Lakeshore

- Hydetown

- Harmonsburg

- Blooming Valley

- Hartstown

- Canadohta Lake

- Adamsville

- Woodcock

- Atlantic

- Geneva

- Riceville

- Pymatuning Central

- Lincolnville

- Pymatuning South

- Pymatuning North

Cities in Indiana County where we do Mortgages:

- Indiana

- Blairsville

- Homer City

- Saltsburg

- Marion Center

- Clymer

- Shelocta

- Armagh

- Cherry Tree

- Plumville

- Glen Campbell

- Smicksburg

- Creekside

- Ernest

- Black Lick

- Lucerne Mines

- Dixonville

- Commodore

- Heilwood

- Rossiter

- Robinson

- Coral

- Chevy Chase Heights

- Jacksonville

Cities in Clearfield County where we do Mortgages:

- Clearfield

- DuBois

- Curwensville

- Houtzdale

- Morrisdale

- Treasure Lake

- Osceola Mills

- Grampian

- Coalport

- Irvona

- Wallaceton

- West Decatur

- Kylertown

- Hyde

- Brisbin

- Mahaffey

- Allport

- Chester Hill

- Bigler

- Ramey

- Glen Hope

- Grassflat

- Troutville

- Westover

- Hawk Run

- Newburg

- Burnside

- Lumber City

- Plymptonville

- New Washington

- Sandy

Cities in Somerset County where we do Mortgages:

- Somerset

- Shanksville

- Windber

- Meyersdale

- Berlin

- Stoystown

- Rockwood

- Friedens

- Jennerstown

- Central City

- Boswell

- Hooversville

- Hollsopple

- Confluence

- Salisbury

- Indian Lake

- Garrett

- New Centerville

- Ursina

- Jerome

- New Baltimore

- Cairnbrook

- Addison

- Wellersburg

- Paint

- Casselman

- Callimont

Cities in Columbia County where we do Mortgages:

- Bloomsburg

- Berwick

- Catawissa

- Benton

- Millville

- Centralia

- Orangeville

- Mifflinville

- Briar Creek

- Buckhorn

- Stillwater

- Numidia

- Conyngham Township

- Lightstreet

- Jamison City

- Aristes

- Mainville

- Lime Ridge

- Jerseytown

- Almedia

- Espy

- Rohrsburg

- Eyers Grove

- Locustdale

- Slabtown

- Wilburton

- Fernville

- Rupert

- Foundryville

- Waller

- Iola

- Jonestown

Cities in Armstrong County where we do Mortgages:

- Kittanning

- Ford City

- Freeport

- Leechburg

- Apollo

- Rural Valley

- Worthington

- Elderton

- West Kittanning

- North Apollo

- Parker

- Dayton

- Manorville

- Templeton

- Ford Cliff

- Applewold

- South Bethlehem

- West Hills

- Lenape Heights

- North Vandergrift

- Atwood

- Orchard Hills

Cities in Carbon County where we do Mortgages:

- Jim Thorpe

- Lehighton

- Palmerton

- Albrightsville

- Lansford

- Nesquehoning

- Summit Hill

- Weatherly

- Bowmanstown

- Weissport

- Parryville

- Beaver Meadows

- Tresckow

- East Side

- Weissport East

Cities in Bradford County where we do Mortgages:

- Towanda

- Sayre

- Troy

- Athens

- Wyalusing

- Canton

- Monroe

- Rome

- New Albany

- Gillett

- Le Raysville

- Burlington

- South Waverly

- Alba

- Sylvania

- Greenes Landing

Cities in Pike County where we do Mortgages:

- Milford

- Matamoras

- Shohola

- Hemlock Farms

- Pine Ridge

- Birchwood Lakes

- Conashaugh Lakes

Cities in Wayne County where we do Mortgages:

- Honesdale

- Hawley

- Waymart

- Lakeville

- Gouldsboro

- Prompton

- Bethany

- White Mills

- Starrucca

- The Hideout

Cities in Venango County where we do Mortgages:

- Franklin

- Oil City

- Seneca

- Polk

- Kennerdell

- Sugarcreek

- Pleasantville

- Cooperstown

- Rouseville

- Clintonville

- Utica

- Barkeyville

- Woodland Heights

Cities in Bedford County where we do Mortgages:

- Bedford

- Everett

- Schellsburg

- Hyndman

- New Paris

- Manns Choice

- Saxton

- Coaldale

- Woodbury

- Rainsburg

- Saint Clairsville

- Defiance

- Stonerstown

Cities in Perry County where we do Mortgages:

- New Bloomfield

- Duncannon

- Newport

- Marysville

- Millerstown

- Blain

- Landisburg

- Liverpool

- New Buffalo

Cities in Mifflin County where we do Mortgages:

- Lewistown

- McVeytown

- Reedsville

- Milroy

- Burnham

- Belleville

- Yeagertown

- Newton Hamilton

- Juniata Terrace

- Strodes Mills

- Highland Park

- Mattawana

- Granville

- Kistler

- Barrville

- Wagner

- Alfarata

- Siglerville

- Potlicker Flats

- Longfellow

- Lucy Furnace

- Atkinson Mills

- Maitland

Cities in Huntingdon County where we do Mortgages:

- Huntingdon

- Mount Union

- Mill Creek

- McConnellstown

- Orbisonia

- Three Springs

- Alexandria

- Petersburg

- Mapleton

- Shirleysburg

- Broad Top City

- Cassville

- Rockhill

- Marklesburg

- Saltillo

- Allenport

- Dudley

- Birmingham

- Coalmont

Cities in Union County where we do Mortgages:

- Lewisburg

- Mifflinburg

- New Columbia

- New Berlin

- Winfield

- Hartleton

- Allenwood

- West Milton

- Laurelton

- Linntown

- Vicksburg

Cities in Jefferson County where we do Mortgages:

- Brookville

- Punxsutawney

- Reynoldsville

- Brockway

- Big Run

- Sykesville

- Summerville

- Corsica

- Worthville

- Timblin

- Crenshaw

- Hamilton

Cities in McKean County where we do Mortgages:

- Smethport

- Bradford

- Kane

- Mount Jewett

- Port Allegany

- Eldred

- Lewis Run

- Rew

Cities in Tioga County where we do Mortgages:

- Tioga

- Wellsboro

- Mansfield

- Blossburg

- Lawrenceville

- Elkland

- Westfield

- Knoxville

- Liberty

- Arnot

- Millerton

- Roseville

Cities in Snyder County where we do Mortgages:

- Selinsgrove

- Middleburg

- Shamokin Dam

- Beavertown

- Beaver Springs

- Freeburg

- Hummels Wharf

- McClure

- Port Trevorton

- Kreamer

- Mount Pleasant Mills

- Penns Creek

- Troxelville

- Paxtonville

- Kratzerville

Cities in Susquehanna County where we do Mortgages:

- Susquehanna

- Montrose

- New Milford

- Hallstead

- Great Bend

- Forest City

- Lanesboro

- Hop Bottom

- Union Dale

- Thompson

- Friendsville

- Little Meadows

- Oakland

Cities in Warren County where we do Mortgages:

- Warren

- Youngsville

- Sheffield

- Tidioute

- Sugar Grove

- Clarendon

- North Warren

- Starbrick

- Bear Lake

- Columbus

- Warren South

Cities in Clinton County where we do Mortgages:

- Lock Haven

- Mill Hall

- Renovo

- McElhattan

- Loganton

- Beech Creek

- Flemington

- Avis

- Castanea

- South Renovo

- Lamar

- Dunnstown

- Rauchtown

- Rote

Cities in Clarion County where we do Mortgages:

- Clarion

- Shippenville

- New Bethlehem

- Knox

- Rimersburg

- Strattanville

- Sligo

- East Brady

- Foxburg

- Callensburg

- Saint Petersburg

- Hawthorn

- Leeper

- Vowinckel

- Marianne

- Crown

Cities in Greene County where we do Mortgages:

- Waynesburg

- Carmichaels

- Jefferson

- Rices Landing

- Greensboro

- Clarksville

- Mount Morris

- Rogersville

- Bobtown

- Wind Ridge

- New Freeport

- Crucible

- Nemacolin

- Mapletown

- Mather

- Morrisville

- West Waynesburg

- Brave

- Fairdale

Cities in Elk County where we do Mortgages:

- Saint Marys

- Ridgway

- Johnsonburg

- Township of Benezette

- Kersey

- Weedville

- Wilcox

- Byrnedale

- James City

- Force

Cities in Wyoming County where we do Mortgages:

- Tunkhannock

- Meshoppen

- Factoryville

- Laceyville

- Nicholson

- Lake Winola

- Noxen

- West Falls

Cities in Juniata County where we do Mortgages:

- Mifflintown

- Port Royal

- Mifflin

- McAlisterville

- Thompsontown

- Richfield

- East Waterford

- Mexico

- East Salem

Cities in Montour County where we do Mortgages:

- Danville

- Washingtonville

- Mechanicsville

Cities in Potter County where we do Mortgages:

- Coudersport

- Galeton

- Ulysses

- Austin

- Shinglehouse

- Genesee Township

- Oswayo

- Ulysses Township

- Sweden Valley

Cities in Fulton County where we do Mortgages:

- McConnellsburg

- Needmore

- Valley-Hi

Cities in Forest County where we do Mortgages:

- Tionesta

- Marienville

Cities in Sullivan County where we do Mortgages:

- Dushore

- Laporte

- Eagles Mere

- Forksville

- Mildred

- Lopez

Cities in Cameron County where we do Mortgages:

- Emporium

- Driftwood

Your Pennsylvania 5 Star Mortgage Broker

Get a Fast Mortgage in Pennsylvania

Click on the video to learn more...Mortgages Explained Pennsylvania: How Much Can I Afford?

If you are serious these days about buying a house in Pennsylvania or even just looking at a home, there is one thing you’d better get – a mortgage preapproval. One of the most frequently asked questions from Pennsylvania home buyers is “How much can I afford?” followed up by “What program is the right fit for me based on my down payment?” These are smart questions and the best place to start is to determine how much down payment you can afford. Compare down payment options and mortgage programs below.

Purchase Price

Down Payment

Down Payment Amount: $36,000

For 20% down payment, you may qualify for the following mortgage loans:

USDA Mortgage

The USDA loan is one of the best zero down payment loans still available today. Its location based meaning it has to be in a USDA approved area and eligibility is determined by household income. Many rural and suburban neighborhoods across American are eligible so it’s a perfect fit for first time and repeat home buyers that want to live in a more rural setting outside city limits.

VA Home Loan

The VA home loan is available to veterans, active military personal, and eligible spouses who have VA entitlement. It required a zero-down payment, requires no mortgage insurance, and offers flexible underwriting guidelines. It’s one of the best programs available today from an affordability standpoint and offers below market rates.

HomeReady / HomePossible

This conventional loan program assists low- to moderate-income borrowers with loans made for certain low-income areas along with more developed areas-based income eligibility. Must be a first-time homebuyer. The programs offers very flexible guidelines with a low 3% down payment and reduced mortgage insurance amounts for approved borrowers.

Conventional 97

The Conventional 97 program is a type of low-down payment mortgage for first time home buyers. There are no income limit restrictions. Borrowers only need to come up with a 3% down payment which makes it a 97% Loan to Value loan. That’s where the program gets its name. It allows for a gift for the down payment and offers common sense underwriting guidelines.

FHA Home Loan

An FHA mortgage is one of the most popular home purchase programs available today, not only for first time home buyers but repeat buyers as well. It requires a small 3.5% down payment and is perfect for borrowers with less than excellent credit, lower income, or past credit events like: foreclosure, bankruptcy, or short sale. This is a government-sponsored program designed to help more people become homeowners. That why the payments are affordable, guidelines are flexible and it offers common sense underwriting.

Conventional 95

The Standard conventional loan offers a low-down payment of 5% and offers loans up to the conventional loan limit currently $510,400. It is designed for borrowers with good to excellent credit (700 or higher) and offers attractive rates and reduced mortgage insurance. The guidelines are less restrictive for borrowers that are considered risk due to a high credit score, solid work history and a low debt to income ratio.

80-10-10

An 80-10-10 loan also known as a “piggyback loan” lets you buy a home with two mortgages that total 90% of the purchase price with only a 10% down payment. Borrowers get a first and second mortgage simultaneously: one for 80% of the purchase price, and one for 10%. One loan “piggybacks” on top of the other. This strategy avoids borrowers paying private mortgage insurance and sidesteps the strict lending requirements of jumbo loans. By taking advantage of this program the overall payment is often less than doing a traditional jumbo mortgage with offers higher interest rates and more restrictive underwriting.

Conventional Home Loan

Unlike the popular belief that 20% is required for this program you can qualify for a conventional home loan with as little as 10% down. Although mortgage insurance is required many home buyers are surprised to learn how affordable it really is with solid credit. This strategy makes sense versus coming up with a large 20% down payment to avoid mortgage insurance entirely.

Traditional Conventional Mortgage

The Traditional Conventional Mortgage option requires no private mortgage insurance (PMI) with 20% down and offers the most favorable terms including the most attractive rates. For borrowers who have a large down payment and great credit it’s the best option when purchasing your home or condo.

Multi-Unit & Investments

You can buy a duplex, triplex, or four-plex by making a down payment of 25% or more. Purchasing a multi-unit home is a great way to get your rental portfolio jump started as a landlord or as a primary residence if plan to move into one of the units and rent out the rest of the units. Whether you plan to live in one of the units or rent out the entire building this program is excellent to secure an income producing property. Homes with up to four units are eligible for the conventional mortgage program.

Find Out How Much Your Pennsylvania Home is Worth!

Enter your address above and and check the esimated value of your home.

Mortgages Explained Pennsylvania: Different Programs

So, you’re ready for a mortgage? Are you a first-time homebuyer or a seasoned investor? Maybe you’re ready to refinance for better rates or get cash out to update your home. No matter what your home loan needs are, you’re in good hands. We have mortgage programs for every situation.

First Time Home Buyer Mortgage

Buying a home for the first time can be a stressful and confusing situation. Where do you start? Can you afford it? The good news is we have a comprehensive list of the best loan programs that you, as a first time home buyer, can take advantage of. These programs offer different benefits depending on your unique situation and are designed to help you reach your goal of homeownership. All with less money out of your own pocket.

- Down payment as low as 3%

- Numerous programs available

- 640 credit score required

Conventional Mortgage

Conventional mortgage loans offer a unique opportunity for borrowers to become homeowners or refinance with more favorable terms. The program has stricter guidelines compared to other loan programs but can be more affordable depending on your financial situation (income, credit score, debts). You will often see down payment requirements as low as 3% – 5% in most cases. One thing you need to know about a conventional home loan is that it is not guaranteed by Uncle Sam. These loans may be a bit tougher to get and can have more stringent qualifications, but the benefit may be worth it.

- 3%-5% down payment

- Above average credit

- Low fixed payment

FHA Mortgage

The FHA loan program has been more popular than ever the last few years as credit has become harder to get. Getting an FHA loan is popular for new first-time home buyers as well as those who have been through a financial credit event like a short sale, foreclosure or other financial hardship in the past and are looking to get a mortgage to get back on track. It was created to help more borrowers realize the dream of homeownership due to its lenient underwriting guidelines and low-down payment options. Due to this, it’s considered the most flexible home loan program available today.

- 3.5% down payment

- Past credit event OK

- Low credit OK

VA Mortgage

The three core advantages of a VA Loan are that it’s specifically tailored to meet the home buying needs of veterans, current service members and military families with flexible terms. These Government backed loans make it possible for veterans to get some of the best financing available for purchasing a new home. The three main areas that benefit Veterans the most are:

- 100% financing

- Below market rates

- No mortgage insurance

Jumbo Mortgage

Jumbo Mortgages offer a unique opportunity for borrowers to buy luxury homes that exceed the conforming loan limit of $647,200. Jumbo mortgage loans have a little stricter lending requirement than other programs but still packs a punch when it comes to upping your buying power. A common misconception about jumbo loans is that you need a 20% down payment in order to qualify. The reality is jumbo financing allows you to purchase with as little as 5% to 10% down with a little creative financing. Yes, that’s right! 5% to 10% down, not the traditional 20%. This is accomplished by establishing a 1st mortgage at the conventional loan limit of $647,200 and 2nd mortgage for the rest of the balance. This “combo loan” avoids mortgage insurance and usually offers the lowest fixed payment.

- 5%-10% down payment

- 660 credit score required

- No mortgage insurance

USDA Mortgage

The USDA Rural Development’s Single-Family Housing Guaranteed Loan Program is designed to help borrowers, low to moderate income earners purchase homes in rural areas. USDA home purchase loans are an excellent benefit for first time home buyers as well as growing families looking to upgrade their living situation. USDA loans are a very attractive 100% financing option for borrowers looking for an affordable home loan option.

- 100% financing

- Rural properties only

- 620 credit score required