Wondering about your rate and down payment? What are your options?

When you work with Moreira Team you have access to amazing loan programs. And your knowledgable mortgage team will work to get you into the best program for your specific needs. This means you get a great rate and a down payment that makes sense for you. If you’re ready to see how much you can afford, give us a call.

Today's Mortgage Rates

- Conventional

- FHA

- VA

- Jumbo

- USDA

- 30yr Fixed

- 15yr Fixed

Conventional 30 YR Fixed

Conventional 15 YR Fixed

FHA 30 YR Fixed

FHA 15 YR Fixed

VA 30 YR Fixed

VA 15yr Fixed

Jumbo 30 YR Fixed

Jumbo 15 YR Fixed

USDA 30 YR Fixed

Rate Table Assumptions

- Conventional Rates shown assume a purchase transaction.

- Annual Percentage Rate (APR) calculations assume a purchase transaction of a single-family, detached, owner-occupied primary residence; a loan-to-value ratio of less than or equal to 96.5%; a minimum FICO score of 740, lock days at 15.

| Term | Loan Amount | LTV | Points |

| 30yr Fixed Conv. | $375,000 | 75.0% | 1 |

| 15yr Fixed Conv. | $375,000 | 75.0% | 1 |

| 30yr Fixed FHA | $289,500 | 96.5% | 1 |

| 15yr Fixed FHA | $289,500 | 96.5% | 1 |

| 30yr Fixed VA | $300,000 | 100.0% | 1 |

| 15yr Fixed VA | $300,000 | 100.0% | 1 |

| 30yr Fixed Jumbo | $900,000 | 75.0% | 1 |

| 15yr Fixed Jumbo | $900,000 | 75.0% | 1 |

| 30yr Fixed USDA | $275,000 | 100.0% | 1 |

- Rates may be higher for loan amounts under $375,000. Please call for details.

- Rates are subject to change without notice.

- Closing Costs assume that borrower will escrow monthly property tax and insurance payments.

- Subject to underwriter approval; not all applicants will be approved.

- Fees and charges apply.

- Payments do not include taxes and insurance.

- Rates based on information gathered from OptimalBlue.

- Mortgage insurance is not included in the payment quoted. Mortgage insurance will be required for all FHA and USDA loans as well as conventional loans where the loan to value is greater than 80%.

- Restrictions may apply. Ask for details.

- Moreira Team | MortgageRight is an Equal Opportunity Lender

“Rate Over X%” Assumptions

- Rates shown assume a refinance transaction.

- Annual Percentage Rate (APR) calculations assume a purchase transaction of a single-family, detached, owner-occupied primary residence; a loan-to-value of 75%; a minimum FICO score of 740; a Loan Term of 360 months; and a loan amount of $375,000 for conforming loans.

- Rates may be higher for loan amounts under $275,000. Please call for details.

- Rates are subject to change without notice.

- Closing Costs assume that borrower will escrow monthly property tax and insurance payments.

- Subject to underwriter approval; not all applicants will be approved.

- Fees and charges apply.

- Payments do not include taxes and insurance.

- Rates based on information gathered from OptimalBlue.

- Mortgage insurance is not included in the payment quoted. Mortgage insurance will be required for all FHA and USDA loans as well as conventional loans where the loan to value is greater than 80%.

- Restrictions may apply.

- Moreira Team | MortgageRight is an Equal Opportunity Lender

Rate Terms Explained

What are Mortgage Points?

Mortgage points, often called discount points, are optional fees that a homebuyer pays at closing in exchange for a reduced interest rate on their mortgage. This process is commonly referred to as "buying down the rate" or a "rate buydown.

What are Lender Credits?

Lender credits are a feature in mortgage financing where the lender agrees to cover some your closing costs in exchange for you accepting a higher interest rate on your loan. This arrangement can make it easier for buyers to afford the upfront costs of purchasing a home.

What is APR?

APR, or annual percentage rate, is a measure of the total yearly cost of borrowing money through a mortgage. Unlike the regular interest rate, which is just the cost of borrowing the principal, the APR incorporates both the interest rate and many of the fees and costs associated with getting your loan.

| Rate Feature | Lender Credit | vs | Discount Points |

| Upfront Costs | Lower (less paid at closing) |

Higher (more paid at closing) |

|

| Interest Rate | Higher Rate | Lower | |

| Long Term Cost | Higher (more interest paid) |

Lower (less interest paid) |

|

| Best for... | Short Term Ownership or Cash Strapped |

Long Term Ownership or Cash Rich |

What is a mortgage, really?

Where do you start?

The average person may never follow through with getting a mortgage because they simply don’t understand what a mortgage is and the steps it takes to get one. It’s actually easier than you think to get started. Our commitment to our clients means that we explain your options as simply as possible. This means you get the best deal possible for your unique situation.

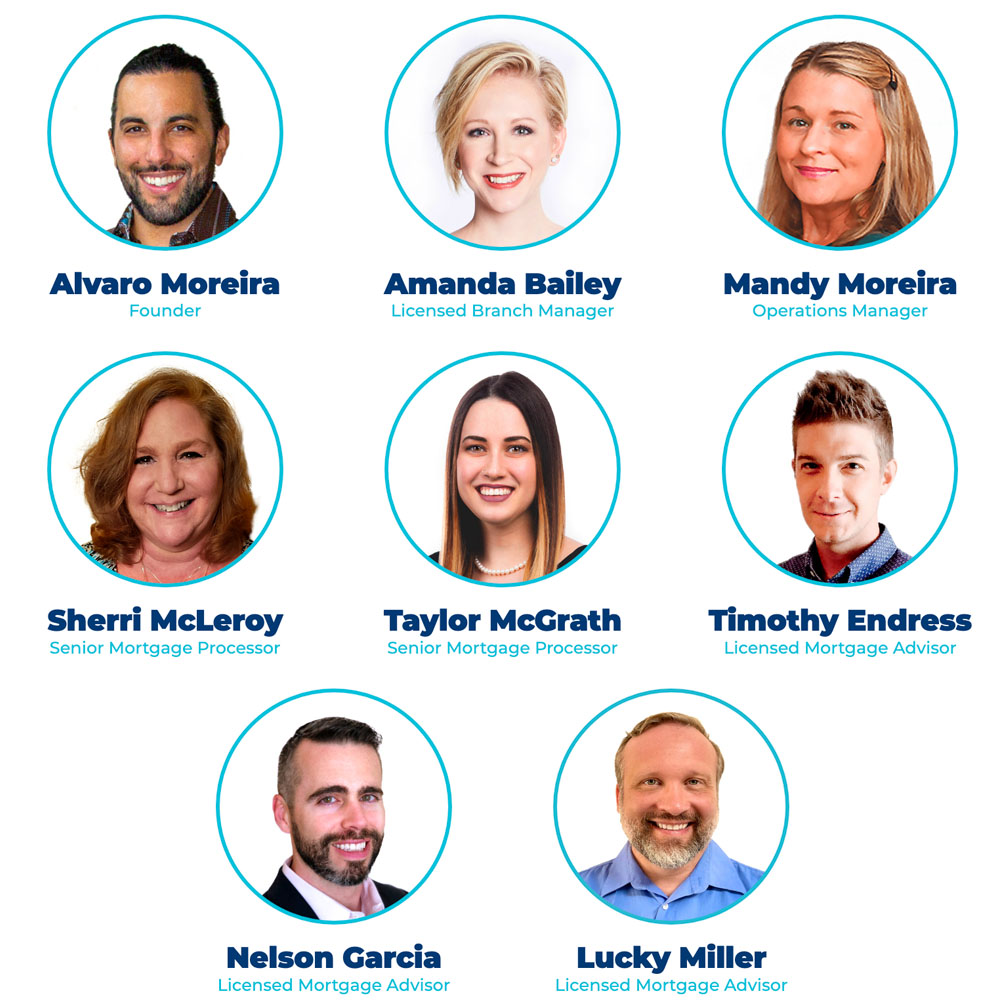

Meet your mortgage team.