In this article

- Step 1: Loan Started

- Step 2: Getting the Package Out to the Lender

- Step 3: Appraisal Requested

- Step 4: Appraisal Completion

- Step 5: Sent to Processing

- Step 6: Submitted to Underwriting

- Step 7: Mortgage Approval Issued

- Step 8: Confirmation of Loan

- Step 9: Conditions Sent in for Final Approval

- Step 10: Clear to Close

- Step 11: Closed

- Step 12: Funded

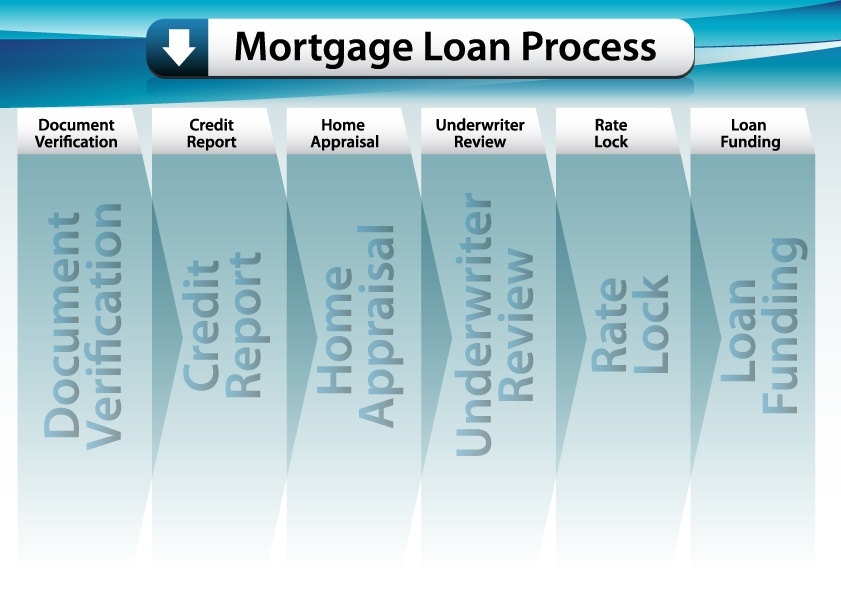

Below are the necessary mortgage process steps for your home purchase. With each progressive step, you will receive a detailed email as well as a follow up phone call to review the steps themselves, provide any assistance that may needed, and address any questions you may have.

Step 1: Loan Started

Apply online, schedule a meeting with your mortgage advisor, or call into get the mortgage loan process rolling

Step 2: Getting the Package Out to the Lender

Electronically sign disclosure package and gather needed documents.

Step 3: Appraisal Requested

We will request an appraisal with a locally certified appraiser.

Step 4: Appraisal Completion

Value is given to your new home and a copy is sent to you.

Step 5: Sent to Processing

Our Processor will oversee the quality control of your loan to send to the Underwriter for Initial Approval.

Step 6: Submitted to Underwriting

Your loan is now awaiting the Initial Approval!

Step 7: Mortgage Approval Issued

An Initial Approval has been issued and we will help to gather any extra documents requested.

Step 8: Confirmation of Loan

We take Step Eight as an opportunity to review the final terms of your loan.

Step 9: Conditions Sent in for Final Approval

We have sent your loan in for Clear to Close.

Step 10: Clear to Close

Our favorite Step. Our closing coordinator will be in touch to schedule your closing.

Step 11: Closed

Reaching this Step means that your closing was a success and your role in the mortgage loan process is now complete.

Step 12: Funded

The final Step in your home purchase journey is now complete, congratulations!

Our team’s #1 goal is that, through these mortgage loan process steps, your home purchase goals have not only been met but have also been exceeded, and that we have gained your trust as a customer for life!