Home Buying is as Easy as 1-2-3!

Check out just how simple we make the home buying process. It’s not as difficult as you might think.

Loan Process OverviewWelcome to Moreira Team!

Take a minute to watch the video below, and see how easy it is to get started on your mortgage.

See What Our Happy Mortgage Customers are Saying.

For years, we’ve been dedicated to helping our clients find the best home loan for their unique needs.

Win the house — even in a bidding war!

In today’s low inventory environment, the housing market is super competitive. So, to help you win the house — even in a bidding war — we offer ALL our borrowers an Upfront Approval Guarantee.

Advantages:

- Your offer is aggressive like a cash offer.

- You can choose to waive the financing and close in 10 days.

- The seller has a guarantee you will close.

First Time Homebuyer? Let's Get You Home.

The prospect of becoming a homeowner for the first time is exciting, but it can also be overwhelming. That’s why we’re here. We’ll guide you every step of the way.

- Choose between several different mortgage options and programs that suit your unique financial and personal situation.

- We help guide you through the entire process from start to finish. You always know what's going on.

- Quick processing and closing to ensure you get into your new home in record time.

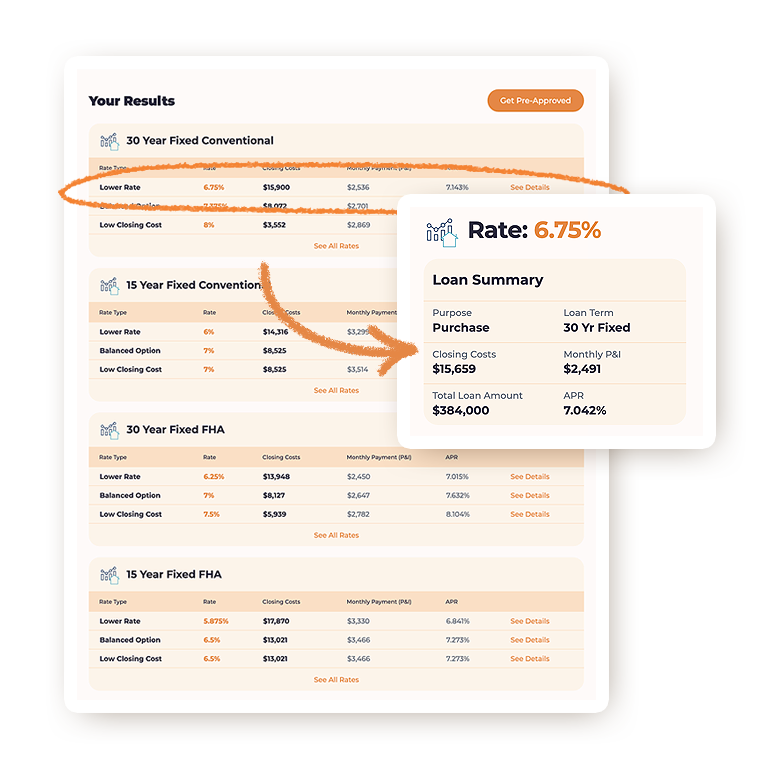

It's Easy to Get Your Custom Mortgage Rate!

Getting your own mortgage rates and closing cost options is fast and easy! It takes less than 60 seconds and is FREE!

See How Easy It IsToday's Mortgage Rates

Candid Feedback from Our Raving Fans.

Some nice words from a few happy clients.

Working with The Moreira Team, specifically Alvaro, was the best decision we made in our home buying process. We used the VA loan and decided to go with a local mortgage company over the usual lender’s people use when using a VA loan. They made the process seamless and straightforward. They answered every question and went above and beyond to ensure we would get our house. We found the house we wanted and closed 5 weeks later. If you are looking for a lender, do not hesitate to use The Moreira Team. I promise you, you will not regret it!

The Moreira Team was amazing to work with! They made the process easy and enjoyable. I highly recommend them!

From the time I first reached out to them more than a year ago to when I finally found a house this year, they were communicative, responsive, and honest. They worked so fast to help me meet the seller’s request for a more accelerated closing period, and throughout the process I always knew what was happening and what I needed to do next.

Highly recommend them.

Al and his team made it so easy to purchase my home! They are extremely responsive and reliable. Once I handed off all my paperwork they handled the rest. They were transparent and honest about everything presented! I couldn’t have done it without them. Thank you so much and I look forward to spreading the word and continuing business with your team!

Every article online says, ‘buying a house is an arduous and complicated process’. Well, it was the complete opposite of that for us working with the Moreira Team! It was a seamless process from beginning to end, and they always answered any questions that we had. We’re so thankful that we found Al, Amanda, Mia, and Kirstin. We close on our new house tomorrow! Thank you so much Moreira Team!

Al’s team is hands down the best at what they do. I have worked with the Moreira Team multiple times and they always deliver on time and what they promised. They are responsive, aggressive with their rates and the live by what they tell you on the front end. If you are considering using them simply do. They have my highest recommendation.

Many thanks to the Moreira Team for helping my wife and I refinance our home. They sure know how to take care of military families! Thank you Amanda Bailey, Al Moreira and Mia Enright for all your hard work. Definitely recommend!

The Moreira Team has been exceptional throughout the purchase of our investment property. From the first phone call to the closing, it’s been peace of mind for us. They take this very personally and give personal time to your case, which separates them from other companies. They always answer calls and are there to guide and support you throughout the process. In our case we were from out of state and they catered to all of our needs. I call Tim, Kristin, Mia & Amanda my dream team in Atlanta, Thank you so much Moreira Team you all ROCK!

Working with these guys was a wonderful experience. They answered all of my many questions very quickly, within minutes typically, and provided everything I needed to get into my new home. They made a tough and exhausting process a bit easier. Would recommend to everyone I know.

Are You Ready to Make a Move?

It's FREE and takes less than a minute to see what you could get.